Tag: Featured

-

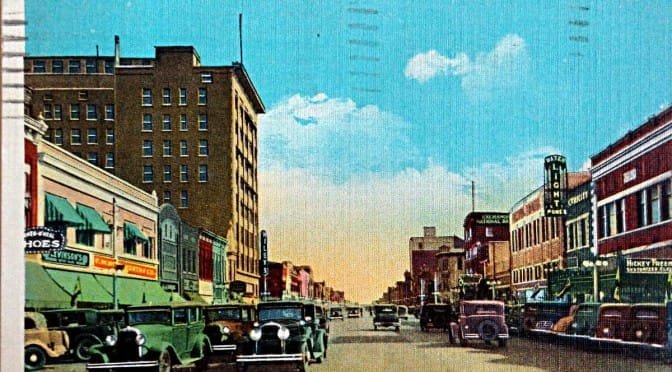

Wichita officials complain of lack of cash for incentives

Wichita has stepped up with cash for incentives when needed, contrary to complaints of economic development officials.

-

The lights are off, and then they’re off

A problem with wasteful spending in downtown Wichita is gradually curing itself, creating another problem in its place.

-

WichitaLiberty.TV: Mayor Carl Brewer’s State of the City address, and the Libertarian Mind

In this episode of WichitaLiberty.TV: We’ll take a look at a few things Wichita Mayor Carl Brewer told the city in his recent State of the City Address. Then a look at topics from a new book titled “The Libertarian Mind: A Manifesto for Freedom.”

-

STAR bonds in Kansas

The Kansas STAR bonds program provides a mechanism for spending by autopilot, without specific appropriation by the legislature.

-

Industrial revenue bonds in Kansas

Industrial Revenue Bonds are a mechanism that Kansas cities and counties use to allow companies to avoid paying property and sales taxes.

-

Community improvement districts in Kansas

In Kansas Community Improvement Districts, merchants charge additional sales tax for the benefit of the property owners, instead of the general public.

-

Kansas must get serious about spending

As Kansas struggles to balance the budget for this year and the next, the state needs to prepare for future budgets by resolving the problem of spending.

-

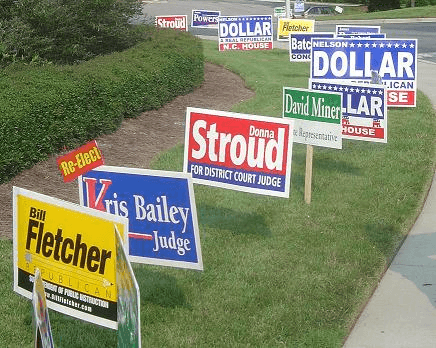

In Kansas, you may display a political sign in your yard

Kansas law overrides neighborhood covenants that prohibit political yard signs before elections.

-

Kansas school employees by type

An interactive visualization of trends in Kansas school employment.

-

WichitaLiberty.TV: That piano, the effect of school choice on school districts, and making Wichita inviting.

The purchase of a piano by a Kansas school district is a teachable moment. Then, how do school choice programs affect budgets and performance of school districts? Finally, making Wichita an inclusive and attractive community.

-

As lawmakers, Kansas judges should be selected democratically

While many believe that judges should not “legislate from the bench,” the reality is that lawmaking is a judicial function. In a democracy, lawmakers should be elected under the principle of “one person, one vote.” But Kansas, which uses the Missouri Plan for judicial selection to its highest court, violates this principle.

-

What we can learn from the piano

The purchase of a piano by a Kansas school district teaches us a lesson. Instead of a system in which schools raise money voluntarily — a system in which customers are happy to buy, donors are happy to give, and schools are grateful to receive — we have strife.