Tag: Kansas Governor

-

WichitaLiberty.TV: Kansas Director of Budget Shawn Sullivan

Kansas Director of Budget Shawn Sullivan joins Karl Peterjohn and Bob Weeks to explain issues related to the Kansas budget.

-

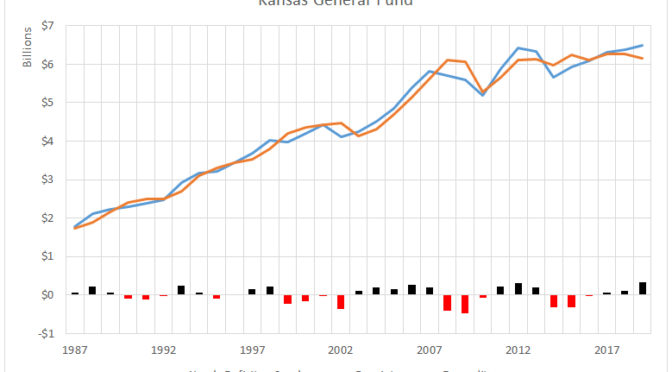

Kansas general fund

Data and charts regarding the Kansas general fund.

-

WichitaLiberty.TV: Kansas politics, school choice, and asset forfeiture

Co-host Karl Peterjohn joins Bob Weeks to discuss a few big developments in Kansas politics, school choice, and civil asset forfeiture.

-

Again, KPERS shows why public pension reform is essential

Proposals in the Kansas budget for fiscal year 2018 are more evidence of why defined-benefit pension plans are incompatible with the public sector.

-

No one is stealing* from KPERS

No one is stealing from KPERS, the Kansas Public Employees Retirement System. But there are related problems.

-

Year in Review: 2016

Here are highlights from Voice for Liberty for 2016. Was it a good year for the principles of individual liberty, limited government, economic freedom, and free markets in Wichita and Kansas?

-

Decoding Duane Goossen

The writing of Duane Goossen, a former Kansas budget director, requires decoding and explanation. This time, his vehicle is “Rise Up, Kansas.”

-

Kansas Governor Sam Brownback on myths and reality

Myth vs Reality: What the media isn’t telling you.

-

From Pachyderm: Radio Host Joseph Ashby

From the Wichita Pachyderm Club this week: Radio Host Joseph Ashby, host of The Joseph Ashby Show. His talk focused on the administration of Kansas Governor Sam Brownback.

-

From Pachyderm: Martin Hawver on Kansas Politics

From the Wichita Pachyderm Club this week: Martin Hawver, dean of Kansas Statehouse press corps, briefed members and guests on the state of Kansas politics.