Tag: Taxation

-

The Biggest Mistake in the Wichita Sales Tax Proposal Is . . .

Dion Lefler argues that Wichita’s proposed sales tax fails as property tax relief because money collected from nonresidents would largely flow back out of the city to absentee property owners.

-

Wichita Forward Moves to Quiet Sales Tax Opposition, Won’t Release Survey Data

Wichita Forward limited public criticism of its proposed 1 percent sales tax by restricting discussion at a forum and refusing to release polling data, drawing complaints from residents and city council members about transparency.

-

Supreme Court Hears Historic Arguments on Trump Tariffs: Can Presidents Tax Without Congress?

Can a president tax Americans without Congress? The Supreme Court just heard explosive arguments on Trump’s tariffs – with justices asking if a future president could declare a climate emergency to impose massive taxes. One justice called it a “one-way ratchet” where Congress would never get its constitutional power back. The stakes: trillions in trade…

-

The Employment and Wage Effects of Trump’s Steel Tariffs

Research on the Trump administration’s 2018-2020 steel tariffs reveals significant negative net employment effects despite modest gains in steel production jobs. While steel workers experienced some wage increases, the broader economic impact included substantial job losses in steel-using industries and higher costs for consumers.

-

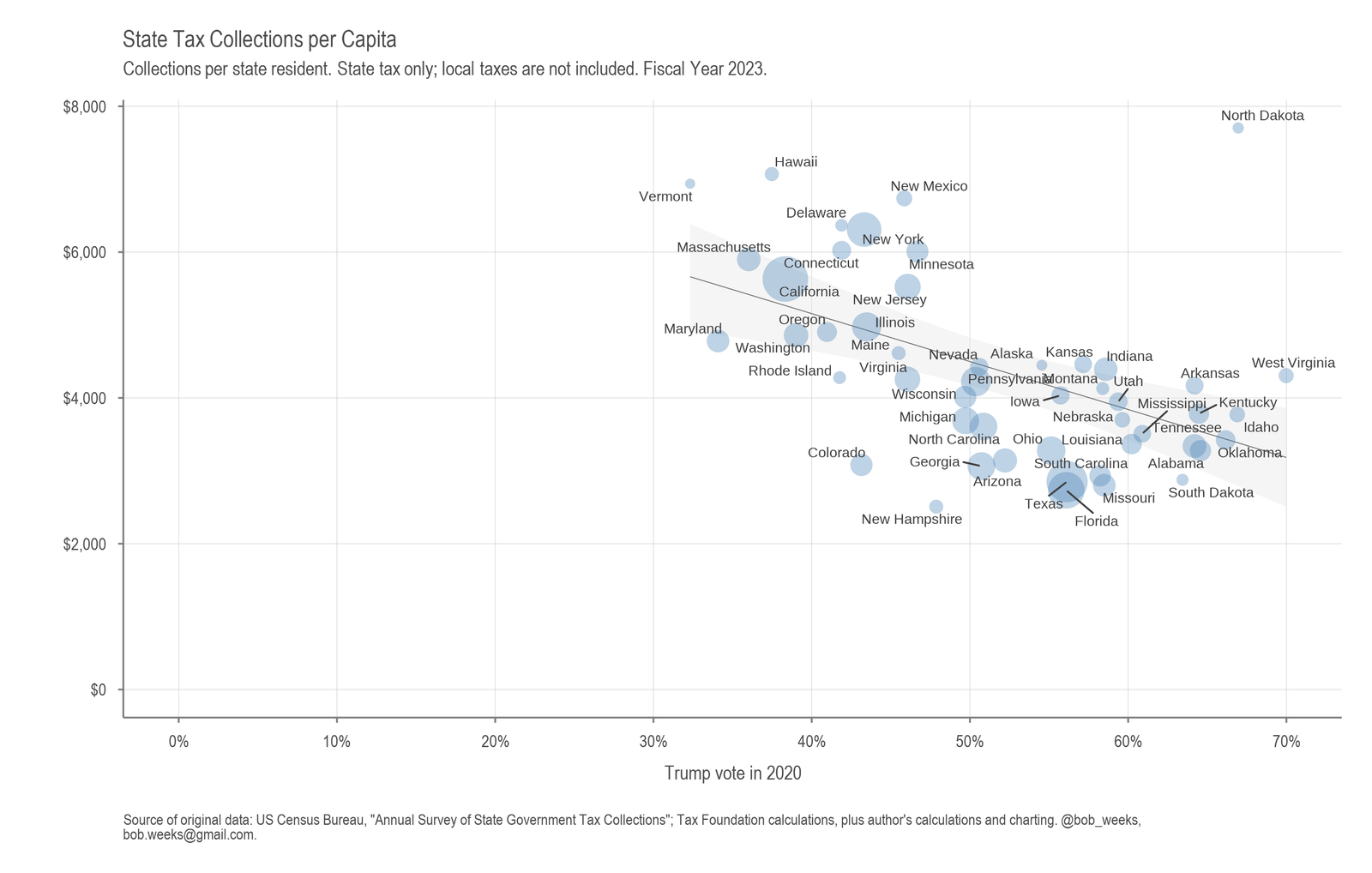

State Tax Collections

Using data from Tax Foundation, I examined state political sentiment and state tax collections.

-

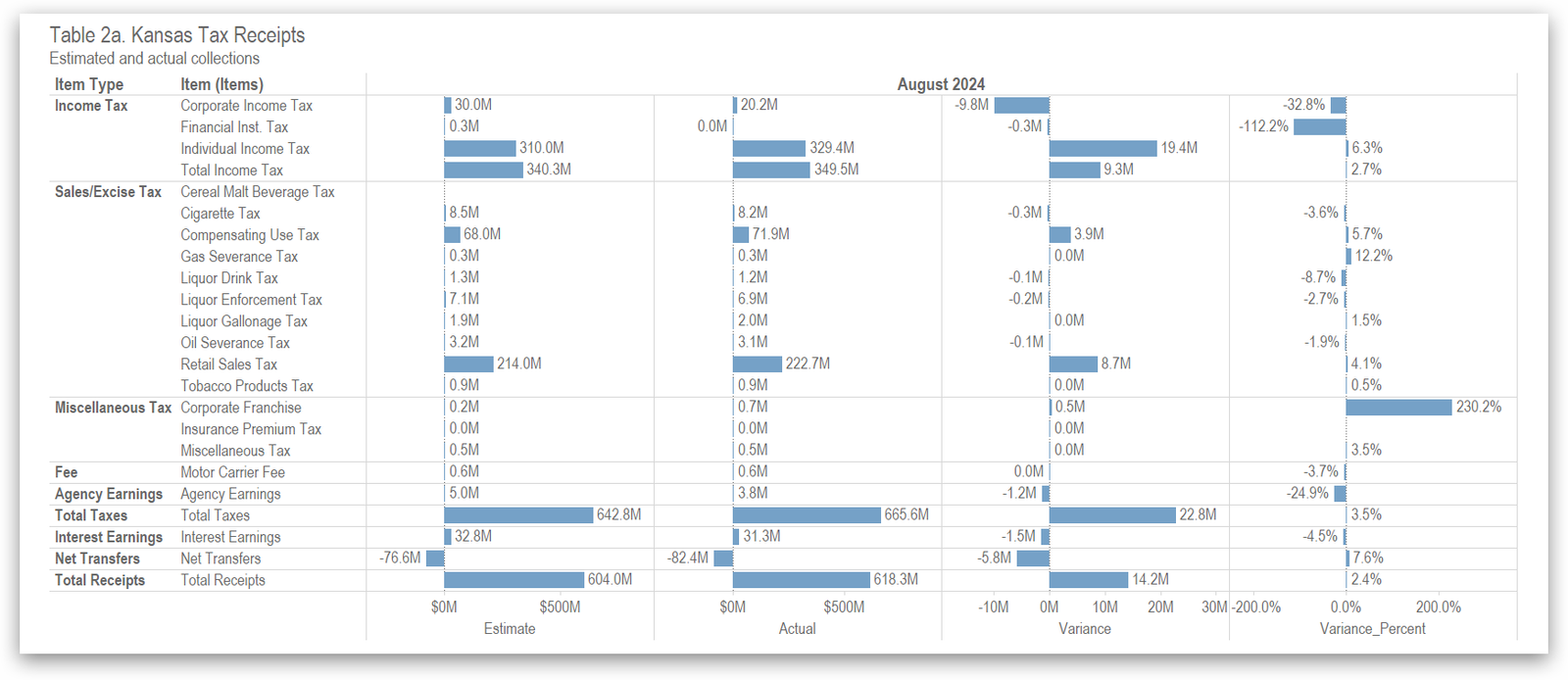

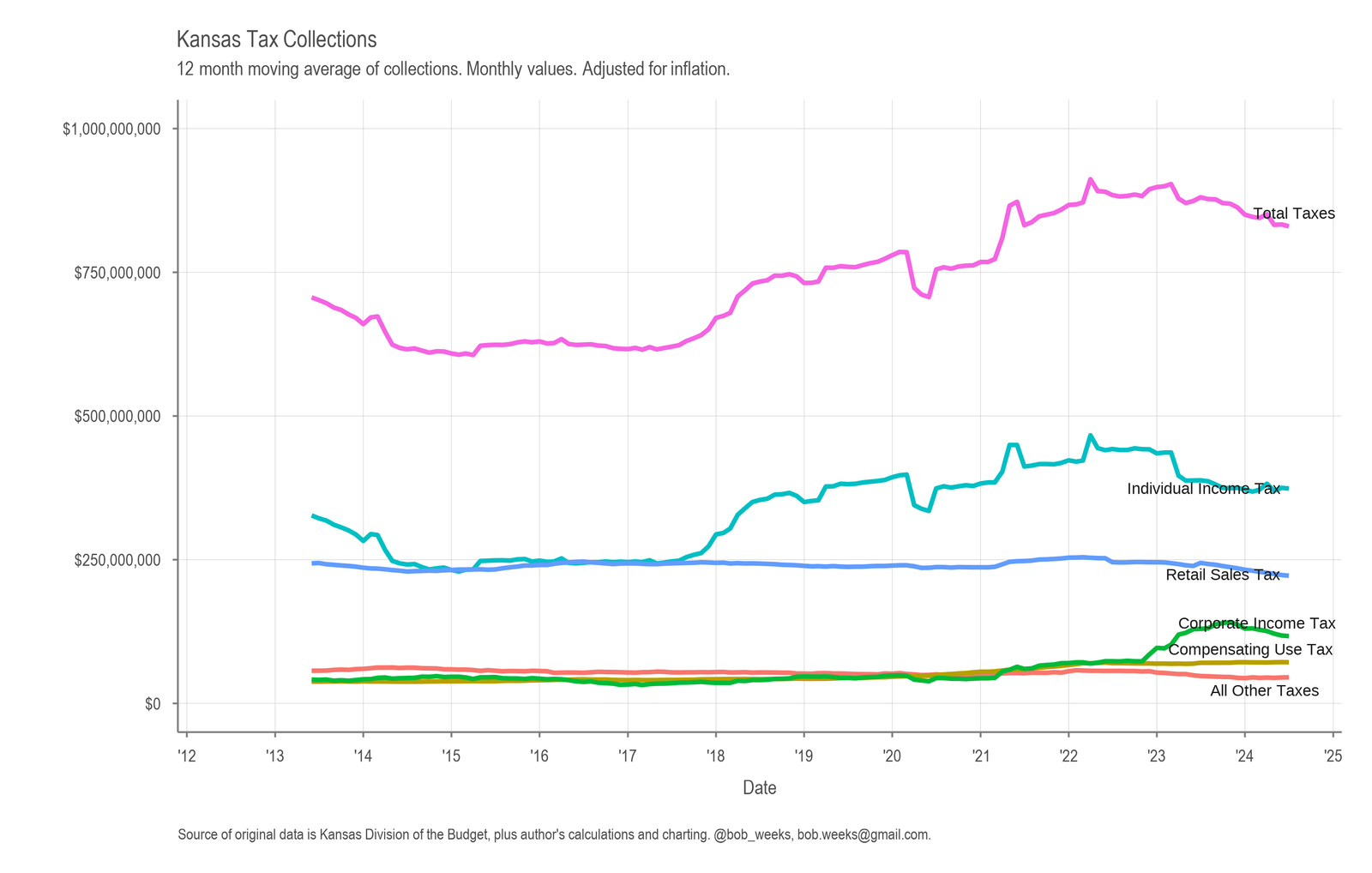

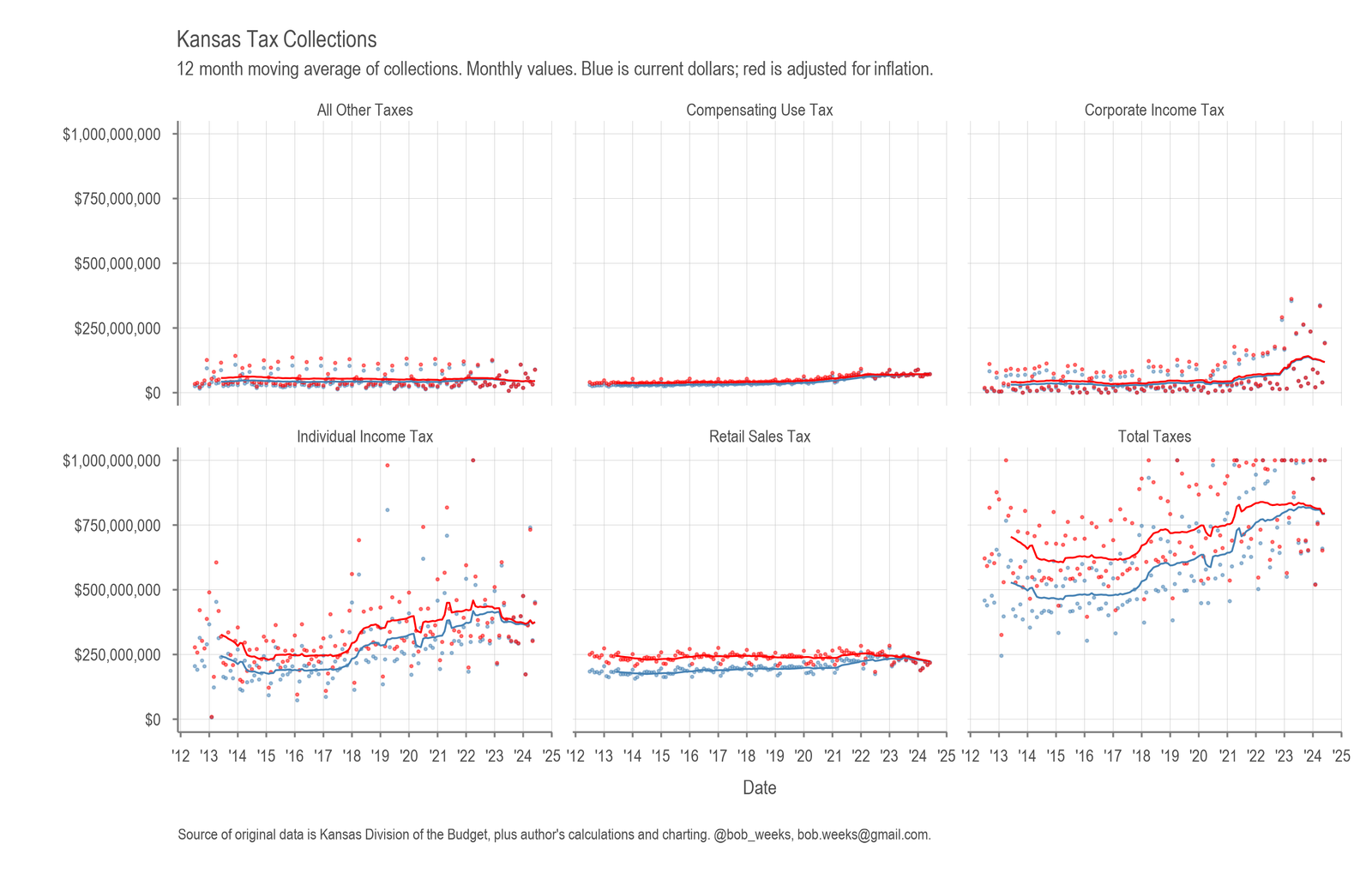

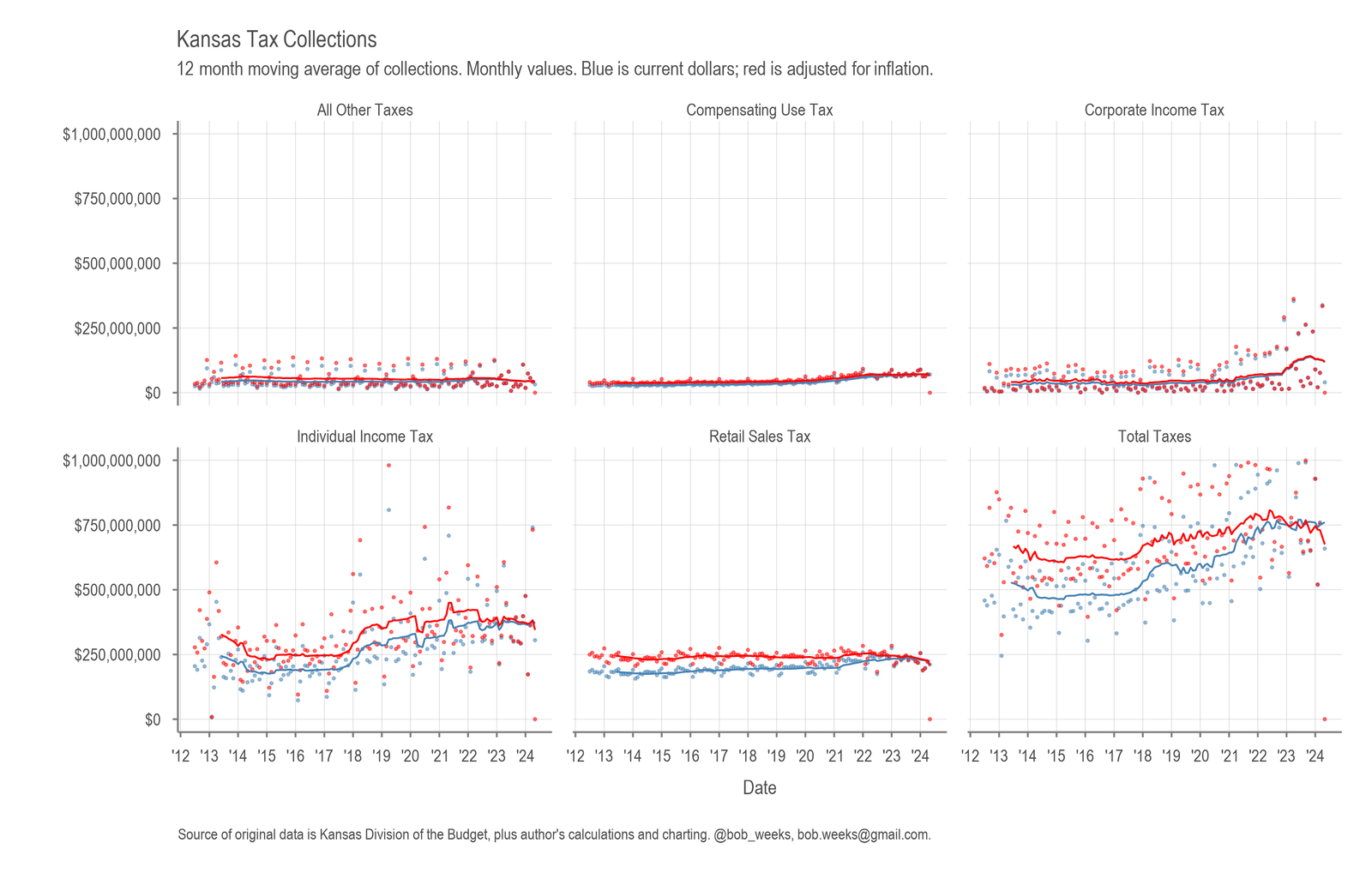

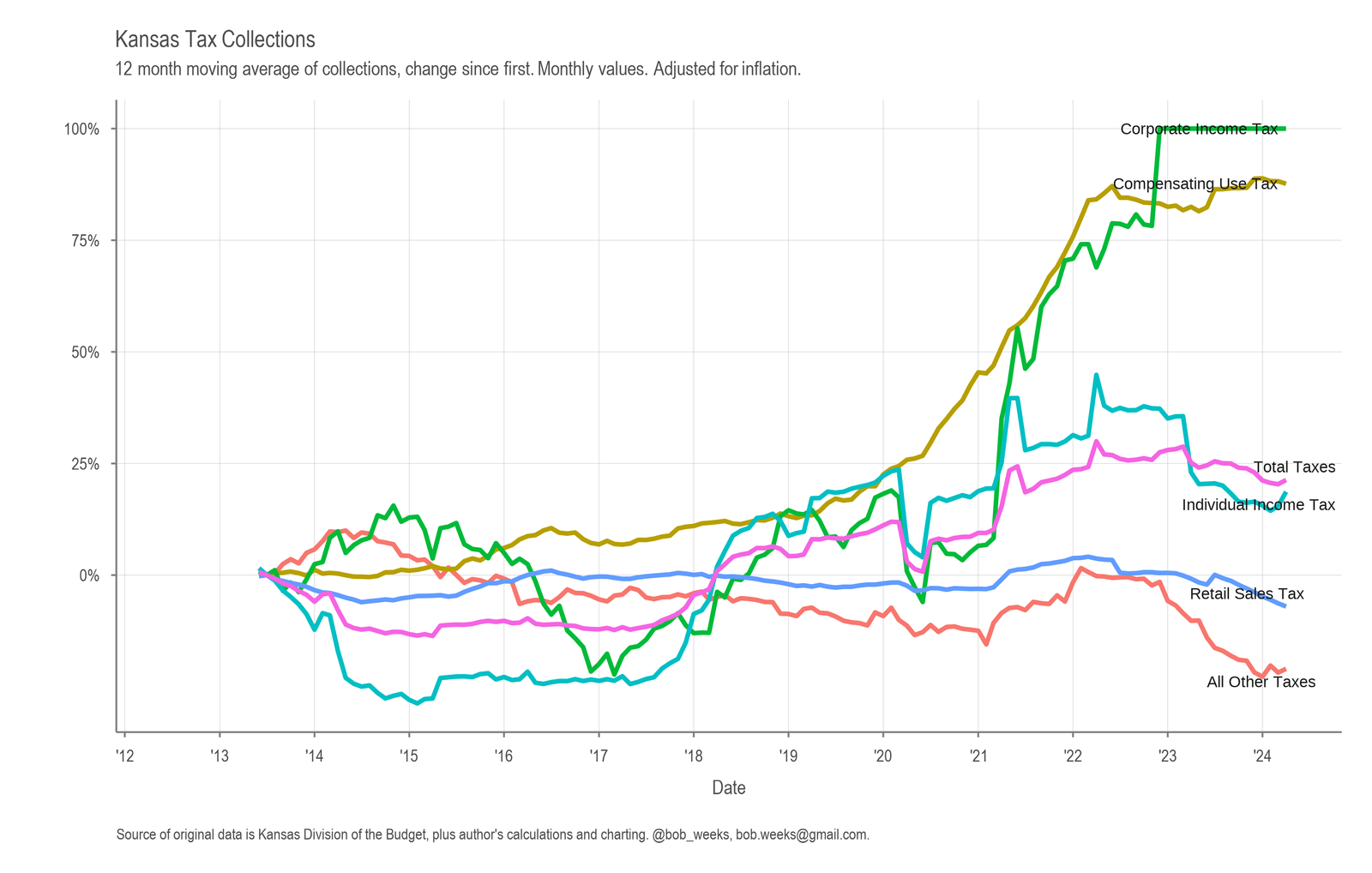

Kansas Tax Revenue, August 2024

For August 2024, Kansas tax revenue was 4.0 percent higher than August 2023, and 3.5 percent higher than estimated.

-

Kansas Tax Revenue, July 2024

For July 2024, Kansas tax revenue was 3.0 percent lower than July 2023, and 1.0 percent less than estimated.

-

Kansas Tax Revenue, June 2024

For June 2024, Kansas tax revenue was 3.9 percent higher than June 2023, and 2.4 percent higher than estimated. For the just-completed fiscal year, collections were lower by 1.5 percent than the previous year, and 2.0 percent lower than estimated.

-

Kansas Tax Revenue, May 2024

For May 2024, Kansas tax revenue was 23.1 percent lower than May 2023, and 22.7 percent lower than estimated.

-

Kansas Tax Revenue, April 2024

For April 2024, Kansas tax revenue was 9.6 percent higher than April 2023, and 7.7 percent higher than estimated.

-

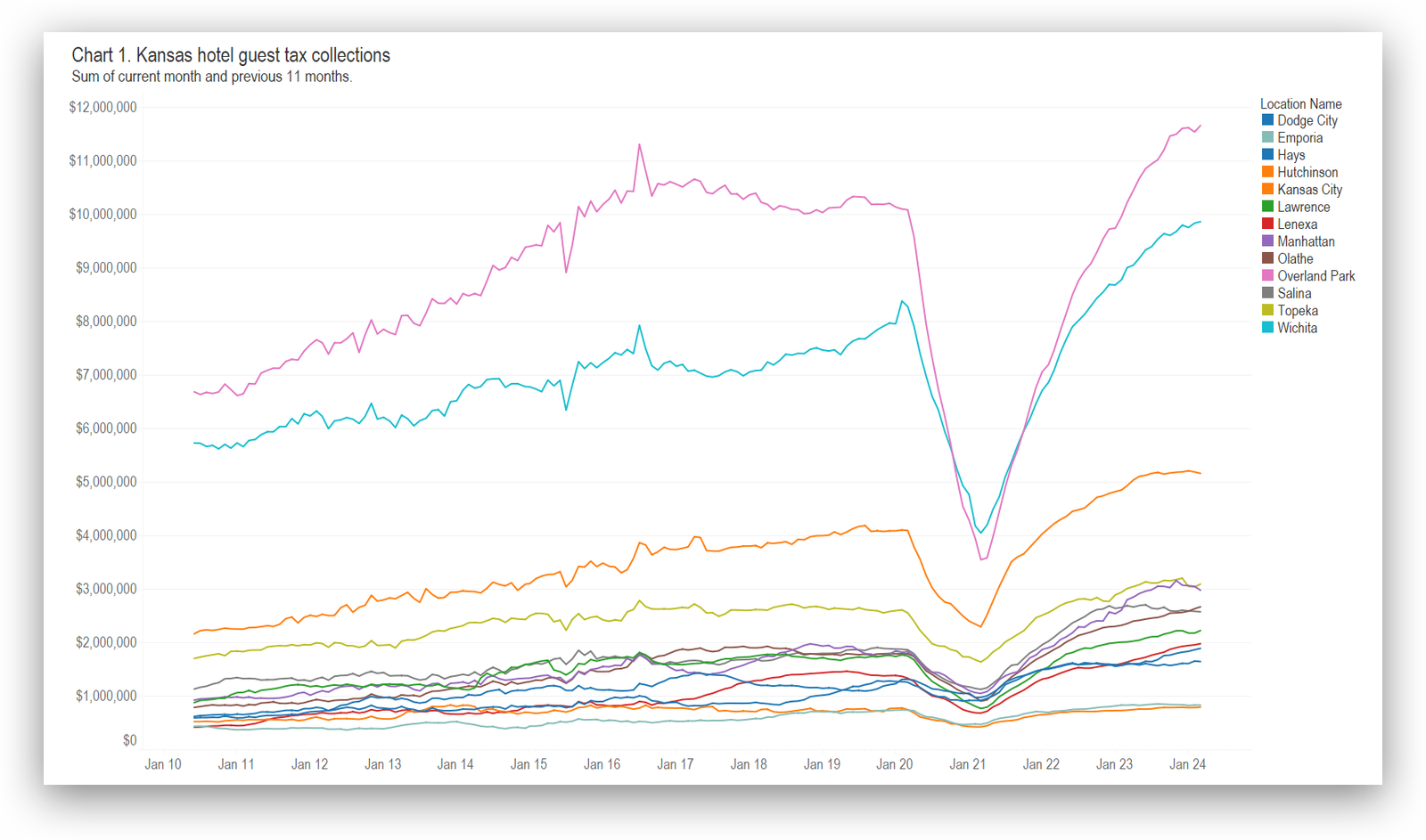

Updated: Kansas hotel guest tax collections

Kansas hotel guest tax collections presented in an interactive visualization. Updated with data through March 2024.