Tag: Taxation

-

To fund government, Wichitans prefer alternatives to raising taxes

Wichita voters told pollsters they prefer adjusting spending, becoming more efficient, using public-private partnerships, and privatization to raising taxes.

-

For Wichita, policies are made to be waived and ignored

The City of Wichita says it wants policies to be predictable and reliable, but finds it difficult to live up to that goal.

-

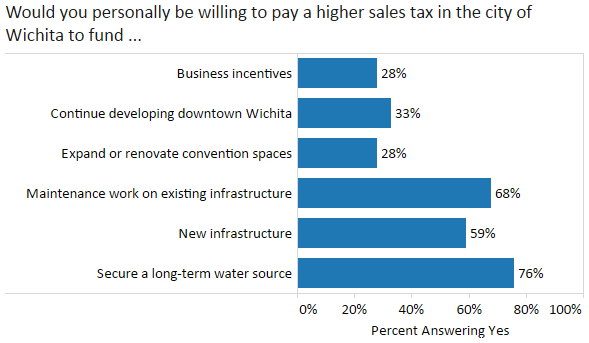

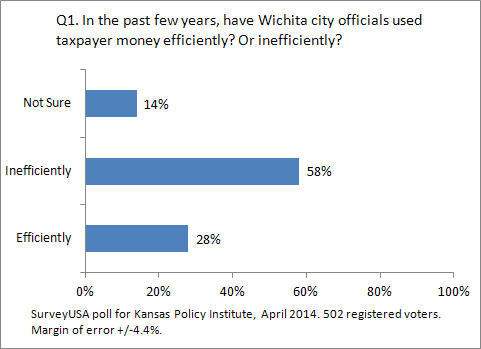

Wichita voter opinion on city spending and taxation

Wichita voters give their opinions on city spending, subsidies for economic development, and their willingness to pay higher taxes for certain services.

-

Wichita government prefers rebates to markets

Today the Wichita City Council may decide to revive a program to issue rebates to persons who purchase water-saving appliances.

-

With new tax exemptions, what is the message Wichita sends to existing landlords?

As the City of Wichita prepares to grant special tax status to another new industrial building, existing landlords must be wondering why they struggle to stay in business when city hall sets up subsidized competitors with new buildings and a large cost advantage.

-

Wichita: We have incentives. Lots of incentives.

Wichita government leaders complain that Wichita can’t compete in economic development with other cities and states because the budget for incentives is too small. But when making this argument, these officials don’t include all incentives that are available.

-

Let’s create something special and unique

As a county commissioner I am focused on creating a special advantage for everyone in Sedgwick County. Eliminating the county’s property tax is an idea whose time has come.

-

WichitaLiberty.TV: Government accounting, Government ownership of infrastructure, and Wichita commercial property taxes

Government leaders tell us they want to run government like a business. But does government actually do this, even when accounting for its money? Then, is it best for government to own all the infrastructure? Finally, taxes on Wichita commercial property are high, compared to the rest of the nation.

-

A lesson for Wichita in economic development

When a prominent Wichita business executive and civic leader asked for tax relief, his reasoning allows us to more fully understand the city’s economic development efforts and nature of the people city hall trusts to lead these endeavors.

-

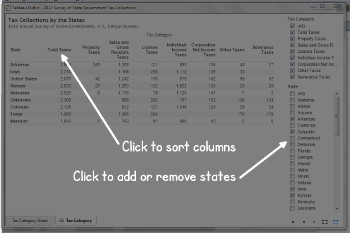

Tax collections by the states

Kansas state government collects more tax revenue than most surrounding states. Additionally, severance taxes are a minor contribution to collections, even in Texas.

-

Kansas City Star’s dishonest portrayal of renewable energy mandate

The Star touts economic gains to the wind industry but ignores the reality that those gains come at the expense of everyone else in the form of higher taxes, higher electricity prices and other unseen economic consequences, writes Dave Trabert of Kansas Policy Institute.

-

Wichita property taxes compared

An ongoing study reveals that generally, property taxes on commercial and industrial property in Wichita are high. In particular, taxes on commercial property in Wichita are among the highest in the nation.