Tag: Wichita city government

-

WichitaLiberty.TV: The caucus and the presidency, Wichita prepares a new regulatory regime

Looking back at the Kansas presidential caucus and should it matter who becomes president. A new regulatory regime in Wichita probably won’t help its stated purpose, but will be harmful. Then, more about regulation.

-

Wichita: A conversation for a positive community and city agenda

Wichita City Manager Robert Layton held a discussion titled “What are Wichita’s Strengths and Weaknesses: A Conversation for a Positive Community and City Agenda.”

-

Wichita economic development items this week

Two economic development items on tap in Wichita this week illustrate failures or shortcomings of the regime.

-

Wichita to impose burdensome occupational requirements

The proposed massage therapist regulations in Wichita are likely to be ineffective, but will limit economic opportunity and harm consumers.

-

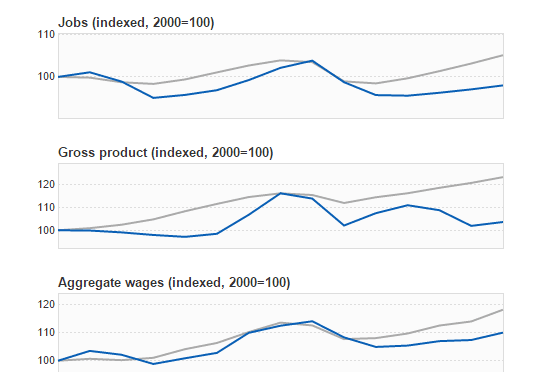

Brookings Metro Monitor and Wichita

A research project by The Brookings Institution illustrates the poor performance of the Wichita-area economy.

-

Massage business regulations likely to be ineffective, but will be onerous

The Wichita City Council is likely to create a new regulatory regime for massage businesses in response to a problem that is already addressed by strict laws.

-

Tax increment financing in Kansas

In this excerpt from WichitaLiberty.TV: How does Tax Increment Financing (TIF) work in Kansas? Is is a good thing, or not?

-

Reforming economic development in Wichita

In this excerpt from WichitaLiberty.TV: Can we reform economic development in Wichita to give us the growth we need?

-

Empowering and engaging Wichitans, or not

Does the City of Wichita really want to “empower and engage citizens by providing information necessary to keep them informed on the actions their government is taking?”

-

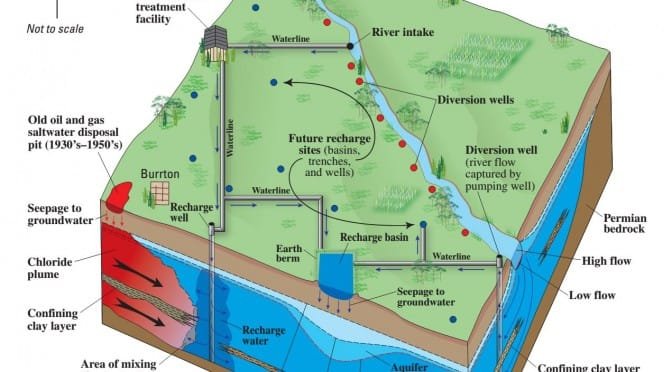

Wichita water statistics update

The Wichita ASR water project produced little water in December. There were 31 days when river flow was adequate.

-

Property rights in Wichita: Your roof

The Wichita City Council will attempt to settle a dispute concerning whether a new roof should be allowed to have a vertical appearance rather than the horizontal appearance of the old.

-

WichitaLiberty.TV: What the Kansas Legislature should do, and eminent domain

There are things simple and noncontroversial that the Kansas Legislasture should do in its upcoming session, and some things that won’t be easy but are important. Also, a look at eminent domain.