Tag: Wichita city government

-

Wichita cheers its planned economy

While success in growing a company is welcome in Wichita, there are broader issues that affect the rest of the metropolitan area.

-

Wichita perpetuates wasteful system of grants; feels good about it

While praising the U.S. Economic Development Administration for a grant to Wichita State university, Wichita city planners boost the growth of wasteful government spending.

-

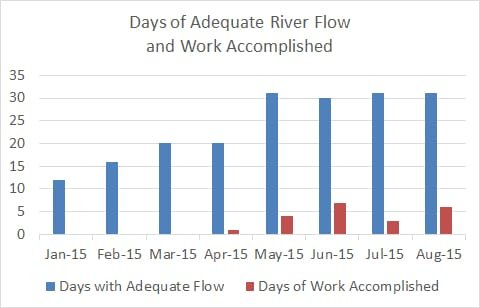

Wichita ASR water project work accomplished

The $247 million Wichita ASR water project operates at just a fraction of its design capacity.

-

James Chung in Wichita, September 23, 2015

James Chung in Wichita, September 23, 2015.

-

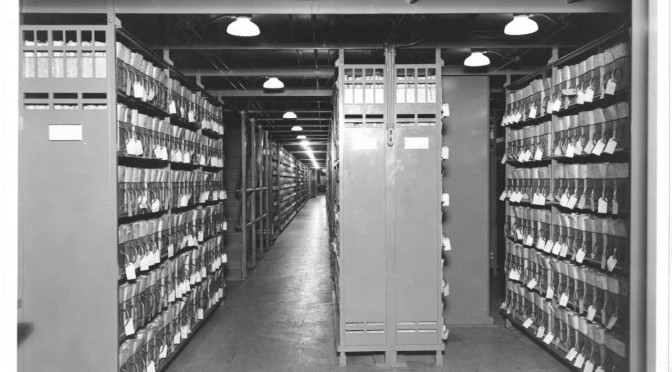

Where are our documents?

Government promotes and promises transparency, but finds it difficult to actually provide.

-

WichitaLiberty.TV: Lack of information sharing by government, community improvement districts, and the last episode of “Love Gov”

Do our governmental agencies really want to share data and documents with us? Community Improvement Districts and homeowners compared. And, the last episode of “Love Gov” from the Independent Institute.

-

Wichita’s demolition policy

Wichita homeowners must pay for demolition of their deteriorating homes, but the owners of a long-festering and highly visible commercial property get to use tax funds for their demolition expense.

-

Wichita can implement transparency, even though tax did not pass

Wichitans have to wonder: Was transparency promised only as an inducement to vote for the sales tax? Or is it a governing principle of our city?

-

Wichita water statistics update

The Wichita ASR water project produced more water in August than in July, but continues to fail to produce water at the projected rate or design capacity.

-

Another week in Wichita, more CID sprawl

Shoppers in west Wichita should prepare to pay higher taxes, if the city approves a Community Improvement District at Kellogg and West Streets.

-

Wichita CID illustrates pitfalls of government intervention

A proposed special tax district in Wichita holds the potential to harm consumers, the city’s reputation, and the business prospects of competitors. Besides, we shouldn’t let private parties use a government function for their exclusive benefit.

-

Wichita Business Journal reporting misses the point

Reporting by the Wichita Business Journal regarding economic development incentives in Wichita makes a big mistake in overlooking where the real money is.