Tag: Wichita city government

-

In Wichita, bad governmental behavior excused

A Wichita newspaper op-ed is either ignorant of, or decides to forgive and excuse, bad behavior in Wichita government, particularly by then-mayoral candidate Jeff Longwell.

-

WichitaLiberty.TV: Wichita economic development, Kansas schools and spending, minimum wage

Can we reform economic development in Wichita to give us the growth we need? Kansas school test scores, school spending, and how the Wichita district spends your money. Then, who is helped by raising the minimum wage?

-

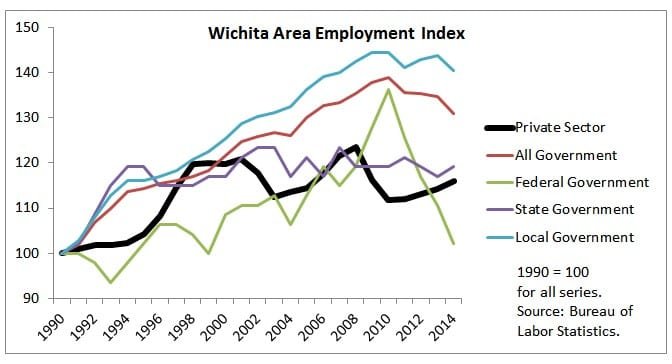

Wichita area job growth

Private sector job growth in the Wichita area is improving, but lags behind local government employment growth.

-

Wichita property tax rates up again

The City of Wichita says that it hasn’t raised its mill levy in many years. Data shows the mill levy has risen, and its use has shifted from debt service to current consumption.

-

Wichita economic development, the need for reform

An incentives deal for a Wichita company illustrates a capacity problem and the need for reform.

-

WichitaLiberty.TV: Kansas revenue and spending, initiative and referendum, and rebuliding liberty

The Kansas Legislature appears ready to raise taxes instead of reforming spending. Wichita voters have used initiative and referendum, but voters can’t use it at the state level. A look at a new book “By the People: Rebuilding Liberty Without Permission.”

-

Wichita economic development policies questioned

The City of Wichita asks for citizens to trust that it has policies in place that will be followed.

-

Did Jeff Longwell dodge a tough city council vote?

On election day, Wichita city council member and mayoral candidate Jeff Longwell appears to have ducked an inconvenient vote and would not say why.

-

Wichita marijuana ballot issue, April 7, 2015

Following is a map of voting for the Wichita marijuana ballot issue, April 7, 2015.

-

Wichita mayoral vote map, April 7, 2015

Following is a map of voting for the Wichita mayoral contest, April 7, 2015.

-

Wichita general election returns, April 7, 2015

Here is a link to a Google Docs sheet of selected returns from the April 7, 2015 Wichita general election, for each precinct.

-

Figeac Aero economic development incentives

Wichita politicians, economic development officials, and civic leaders bemoan the lack of incentives Wichita can offer. A deal under consideration illustrates what is really available.