Tag: Wichita city government

-

WichitaLiberty.TV: Radio show host Joseph Ashby

In this episode of WichitaLiberty.TV: Radio talk show Joseph Ashby appears to talk about transparency in the Kansas Legislature and the State of the City Address for Wichita.

-

WichitaLiberty.TV: Wichita city government and upcoming elections

In this episode of WichitaLiberty.TV: We’ll take a look at how city government and council meetings operate. Then, there are city elections coming up. How can you get involved? How can you decide which candidates to support?

-

Wichita city hall falls short in taxpayer protection

An incentives agreement the Wichita city council passed on first reading is missing several items that city policy requires. How the council and city staff handle the second reading of this ordinance will let us know for whose interests city hall works: citizens, or cronies.

-

WichitaLiberty.TV: Rodney Wren

Rodney Wren is a debate and forensics coach. I asked him what can we do to improve the political process, particularly regarding candidate debates and the two major political parties?

-

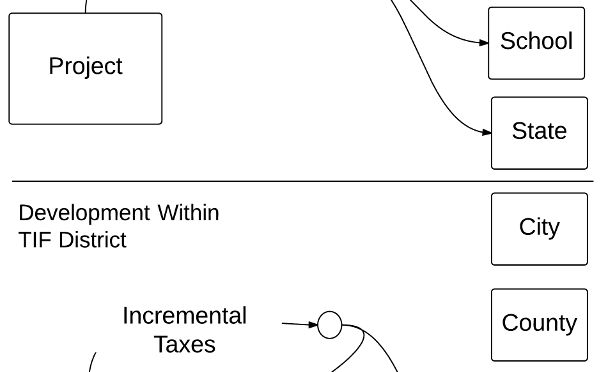

Wichita TIF projects: some background

Tax increment financing disrupts the usual flow of tax dollars, routing funds away from cash-strapped cities, counties, and schools back to the TIF-financed development. TIF creates distortions in the way cities develop, and researchers find that the use of TIF means lower economic growth.

-

Wichita loan agreement subject to interpretation

In 2009 the City of Wichita entered into an ambiguous agreement to grant a forgivable loan, and then failed to follow its own agreement. Worse yet, there has been no improvement to similar contracts. Such agreements empower the city to grant favor at its discretion.

-

Wichitaliberty.TV: Special taxes for artists

In this excerpt from WichitaLiberty.TV: Wichita government spending on economic development leads to imagined problems that require government intervention and more taxpayer contribution to resolve. The cycle of organic rebirth of cities is then replaced with bureaucratic management.

-

A chance for Wichita to embrace transparency

Promises of transparency were made during the recent Wichita sales tax campaign. If the city cares about government transparency, the city should implement its promises, even though the tax did not pass.

-

Clawbacks illustrate difficulty of economic development

Politicians and government officials like clawbacks in economic development incentive agreements. But do these provisions have any negative aspects?

-

Year in Review: 2014

Here is a sampling of stories from Voice for Liberty in 2014.

-

In Wichita, running government like a business

In Wichita and Sedgwick County, can we run government like a business? Should we even try? Do our leaders think there is a difference?

-

Economic development in Wichita: Looking beyond the immediate

Decisions on economic development initiatives in Wichita are made based on “stage one” thinking, failing to look beyond what is immediate and obvious.