For July 2022, Kansas tax revenue was 2.7 percent less than July 2021. There are special circumstances.

Tax reports from the State of Kansas for July 2022 show tax revenues falling from the previous month and also from the same month the prior year.

When reporting on Kansas tax collections, the comparison is usually to the estimated tax collections. Those estimates are revised based on economic conditions. To get a feel for the effects of the Kansas economy and state tax policy, we should compare to the same month the prior year. (The estimated revenue figures are still important because the state bases the budget on them. If the actual revenue is below the estimated revenue, there may not be enough income to pay expenses.)

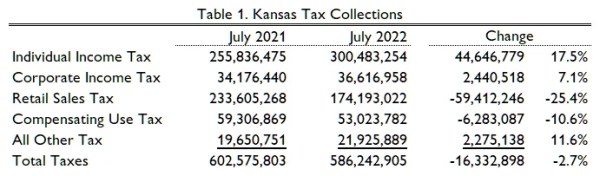

For July 2022, individual income tax collections were $300.4 million, up 17.5 percent from last July. Retail sales tax collections fell by 25.4 percent from last July to $174.2 million. Total tax collections were $586.2 million, down 2.7 percent from last July. Table 1 summarizes. (Click charts and tables for larger versions.)

The large drop in sales tax collections can easily be seen in Chart 4, which compares collections to the same month of the previous year. This drop is likely due to a Covid relief bill passed this year. (1)http://www.kslegislature.org/li/b2021_22/measures/hb2106/

In its presentation of this data in May, Kansas Legislative Research noted this regarding retail sales tax collections: “The increase was primarily driven by the impact of inflation on prices.” The inflation rate is still high, even higher, but retail sales tax collections fell. The effects of the Covid relief legislation complicate any analysis. While Kansas passed legislation to reduce the sales tax on food, the first reduction to a lower rate of 4.0 percent isn’t effective until the start of 2023. (2)http://www.kslegislature.org/li/b2021_22/measures/documents/summary_hb_2106_2022

July is the first month of fiscal year 2022, so I omit Table 2, which compares fiscal years.

Kansas tax revenues continue to outperform estimates. When the line is above zero in nearby Chart 5a, actual revenue was greater than the estimate. This line is nearly always positive for the past five years or so. Estimates are essential because the legislature uses them to make spending decisions. Beyond that, the variance between actual revenue and the estimate doesn’t have much meaning. The governor uses a positive variance as a sign of economic success. While her office did not issue a press release for the July data, she was quoted saying: “Due to my administration’s record-setting economic development successes over the last three and a half years, July marks the 24th month in a row that Kansas tax receipts have surpassed expectations.” (3)https://www.wibw.com/2022/08/02/kansas-tax-collections-continue-bust-estimates-with-5862-million-collected/

Using the fact of exceeding estimates as an indication of economic success is problematic. It just as easily means the estimates are wrong, possibly for reasons other than the inherent difficulties of making estimates. When considering the health of the Kansas economy, there are other measures that are more significant. See, for example:

- Kansas employment situation, June 2022. In Kansas for June 2022, the labor force grew, the number of people working grew, and the unemployment rate rose, all compared to the previous month. While the monthly change for Kansas ranks well, over the year Kansas job growth was worst among the states.

- Business Formation in Kansas. For both business applications and business formations, Kansas lags many states and the nation.

- Kansas Personal Income, First Quarter 2022. For the first quarter of 2022, Kansas personal income grew at the annual rate of 4.2 percent, ranking thirty-fourth among the states.

- Kansas GDP, First Quarter of 2022. In the first quarter of 2022, the Kansas economy contracted at the annual rate of 2.6 percent. Gross Domestic Product fell in 46 states, with Kansas ranking thirty-ninth.

Over the past five or so years, revenues have exceeded estimates, sometimes by large margins. Chart 5b shows the cumulative variance for each fiscal year, with a positive number meaning actual collections were greater than estimated. The trend of positive variances starting with fiscal year 2018 is distinct. This chart does not show total collections and does not illustrate the health of the Kansas economy. It simply compares estimates to actuals.

I have updated my interactive visualization of Kansas tax revenue with this data. Click here to use it.

This month saw one large fund transfer, $127.1 million to Department of Education’s School District Capital Improvement Fund.

The governor issued no press release on this topic for this month. The report from Kansas Legislative Research Department is here.

Leave a Reply