Tag: Cronyism

-

WichitaLiberty.TV: The harm of cronyism, local and national

Does Wichita have a problem with cronyism? The mayor, city council, and bureaucrats say no, but you can decide for yourself. Then, from LearnLiberty.org, the harm of cronyism at the national level.

-

Is there a problem in Wichita?

Does Wichita have a problem with cronyism? The mayor, city council, and bureaucrats say no, but you can decide for yourself.

-

In Wichita, the news is not always news the city thinks you should know

In February 2012 the City of Wichita held an election, but you wouldn’t have learned of the results if your only news source was the city’s website or television station.

-

WichitaLiberty.TV: Tech advice for activism, then a lesson in economic development in Wichita

In this episode of WichitaLiberty.TV: A few tips on using your computer and the internet. Then, how to be informed. Finally, a look at a recent episode of economic development in Wichita, and what we can we learn from that.

-

Before asking for more taxes, Wichita city hall needs to earn trust

Before Wichita city hall asks its subjects for more tax revenue, it needs to regain the trust of Wichitans.

-

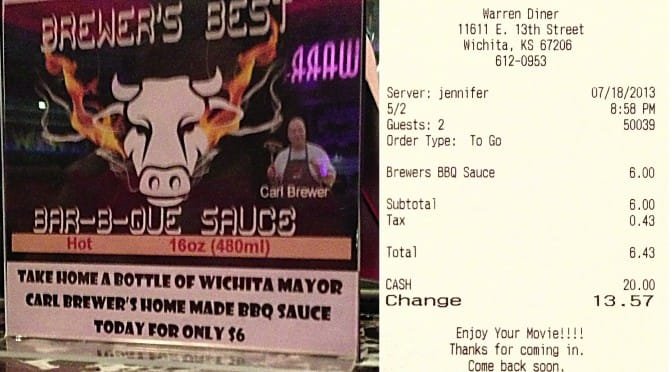

Problems with the Wichita economy. Is it cronyism?

The Wichita economy has not performed well. Could cronyism be a contributing factor? Mayor Carl Brewer says it’s time to put politics and special interests aside. Is our political leadership capable of doing this?

-

With new tax exemptions, what is the message Wichita sends to existing landlords?

As the City of Wichita prepares to grant special tax status to another new industrial building, existing landlords must be wondering why they struggle to stay in business when city hall sets up subsidized competitors with new buildings and a large cost advantage.

-

Let’s create something special and unique

As a county commissioner I am focused on creating a special advantage for everyone in Sedgwick County. Eliminating the county’s property tax is an idea whose time has come.

-

A lesson for Wichita in economic development

When a prominent Wichita business executive and civic leader asked for tax relief, his reasoning allows us to more fully understand the city’s economic development efforts and nature of the people city hall trusts to lead these endeavors.

-

In Wichita, ‘free markets’ cited in case for economic development incentives

A prominent Wichita business uses free markets to justify its request for economic development incentives. A gullible city council buys the argument.

-

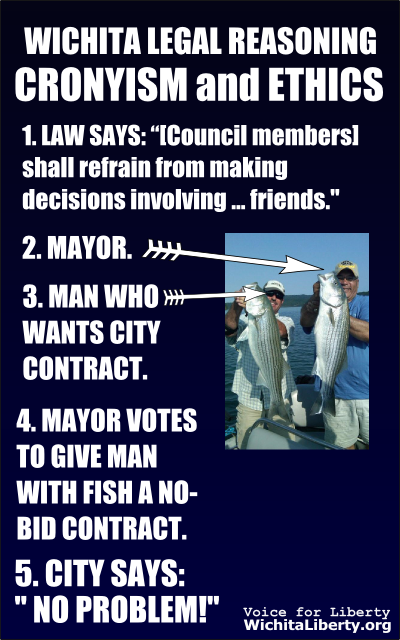

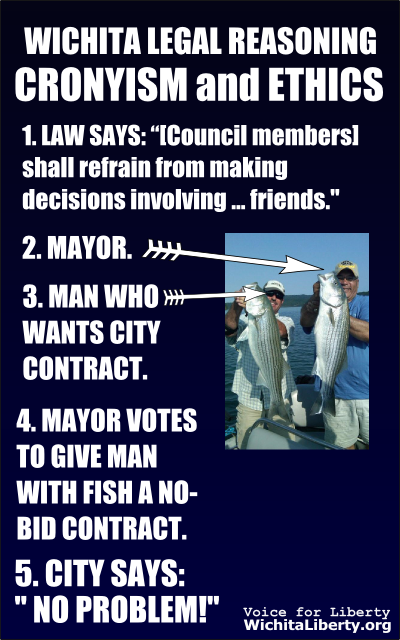

Questions for the next Wichita city attorney: Number 3

Will the next Wichita city attorney advise council members to refrain from making decisions worth millions to their friends and significant campaign contributors?

-

Poll: Wichitans don’t want sales tax increase

A scientific poll commissioned by Kansas Policy Institute finds that Wichitans are opposed to business incentives, want to pursue privatization over tax increases, and have concerns about how city hall has recently spent money.