Tag: Downtown Wichita

-

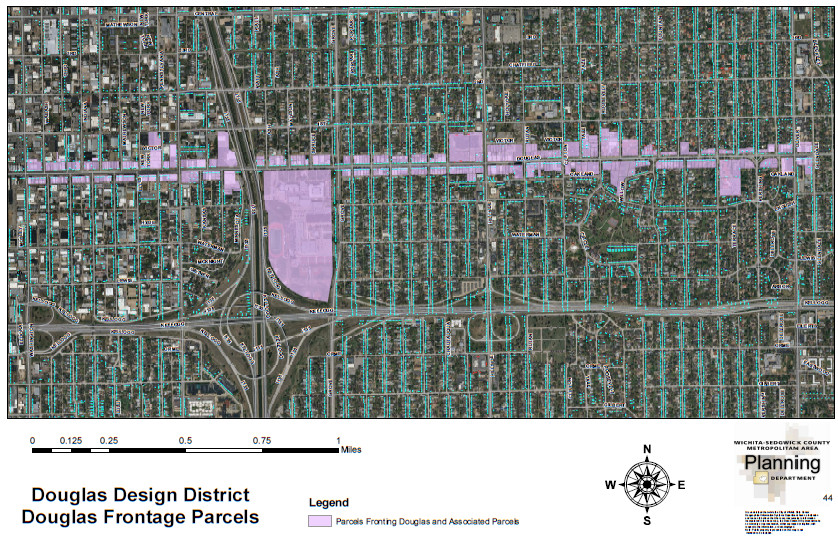

Business improvement district on tap in Wichita

The Douglas Design District seeks to transform from a voluntary business organization to a tax-funded branch of government.

-

It may become more expensive in Wichita

The City of Wichita plans to create a large district where extra sales tax will be charged.

-

Downtown Wichita population is up

New Census Bureau data shows the population growing in downtown Wichita.

-

Downtown Wichita jobs rise

The number of jobs in downtown Wichita rose sharply in 2017.

-

From Pachyderm: Save Century II

From the Wichita Pachyderm Club: Speakers promoting the saving of the Century II Convention and Performing Arts Center in downtown Wichita.

-

From Pachyderm: Save Century II

From the Wichita Pachyderm Club: Speakers promoting the saving of the Century II convention and performing arts center in downtown Wichita.

-

Checking a Jeff Longwell for Mayor political ad

An ad from the Jeff Longwell for Mayor Committee contains a false claim.

-

In Wichita, more tax increment financing

The Wichita city council will consider expanding an existing TIF, or tax increment financing district.

-

What the Block 1 amendment says about downtown Wichita

The amending of a retail lease tells us a lot about the economics of downtown Wichita.

-

Contribute to a campaign, get (nearly) free rent

Citizens may not have noticed that a campaign contributor to Wichita Mayor Jeff Longwell received a large benefit from the city this week.

-

Downtown Wichita population

Wichita economic development officials use a convoluted method of estimating the population of downtown Wichita, producing a number much higher than Census Bureau estimates.

-

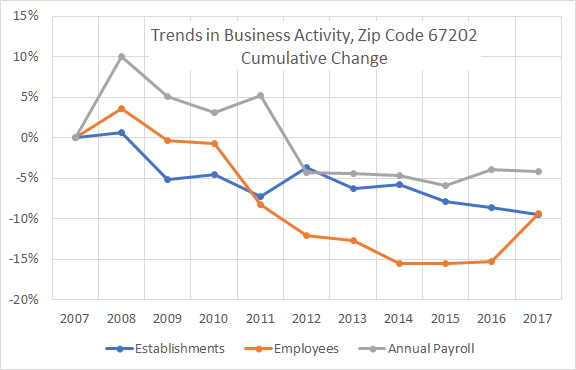

Downtown Wichita jobs decline

Despite heavy promotion and investment in downtown Wichita, the number of jobs continues to decline.