Tag: Economic development

-

With new tax exemptions, what is the message Wichita sends to existing landlords?

As the City of Wichita prepares to grant special tax status to another new industrial building, existing landlords must be wondering why they struggle to stay in business when city hall sets up subsidized competitors with new buildings and a large cost advantage.

-

Wichita: We have incentives. Lots of incentives.

Wichita government leaders complain that Wichita can’t compete in economic development with other cities and states because the budget for incentives is too small. But when making this argument, these officials don’t include all incentives that are available.

-

Let’s create something special and unique

As a county commissioner I am focused on creating a special advantage for everyone in Sedgwick County. Eliminating the county’s property tax is an idea whose time has come.

-

A lesson for Wichita in economic development

When a prominent Wichita business executive and civic leader asked for tax relief, his reasoning allows us to more fully understand the city’s economic development efforts and nature of the people city hall trusts to lead these endeavors.

-

In Wichita, ‘free markets’ cited in case for economic development incentives

A prominent Wichita business uses free markets to justify its request for economic development incentives. A gullible city council buys the argument.

-

Wichita property taxes compared

An ongoing study reveals that generally, property taxes on commercial and industrial property in Wichita are high. In particular, taxes on commercial property in Wichita are among the highest in the nation.

-

What is the record of economic development incentives?

On the three major questions — Do economic development incentives create new jobs? Are those jobs taken by targeted populations in targeted places? Are incentives, at worst, only moderately revenue negative? — traditional economic development incentives do not fare well.

-

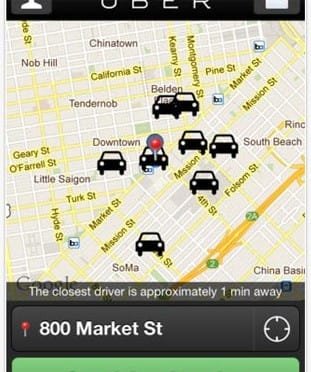

WichitaLiberty.TV: Uber not for Wichita, Wichita fails at transparency, and Wichita jobs

Uber is an innovative transportation service, but is probably illegal in Wichita. Then, the City of Wichita fails again at basic government transparency. Finally, a look at job growth in Wichita compared to other cities.

-

‘Earmark Distribution Agency,’ dealer of pork, proposed for elimination

Congressman Mike Pompeo, R-Kansas, offered an amendment to H.R. 4660, the Commerce, Justice, Science, and Related Agencies Appropriations Act for Fiscal Year 2015, to eliminate the Economic Development Administration (or the “Earmark Distribution Agency”).

-

In Kansas and Wichita, there’s a reason for slow growth

If we in Kansas and Wichita wonder why our economic growth is slow and our economic development programs don’t seem to be producing results, there is data to tell us why: Our tax rates are too high.

-

Uber, not for Wichita

A novel transportation service worked well for me on a recent trip to Washington, but Wichita doesn’t seem ready to embrace such innovation.

-

Is Wichita chasing class politics to its detriment?

It turns out that the benefits of appealing to the creative class accrue largely to its members — and do little to make anyone else any better off.