Tag: Featured

-

WichitaLiberty.TV: Senator Jim DeMint and Convention of States

Former United States Senator Jim DeMint joins Karl Peterjohn and Bob Weeks to talk about the Convention of States. David Schneider, regional director for Citizens for Self-Governance also appears.

-

Wichita school revenue

Revenue for the Wichita public school district continues its familiar trend.

-

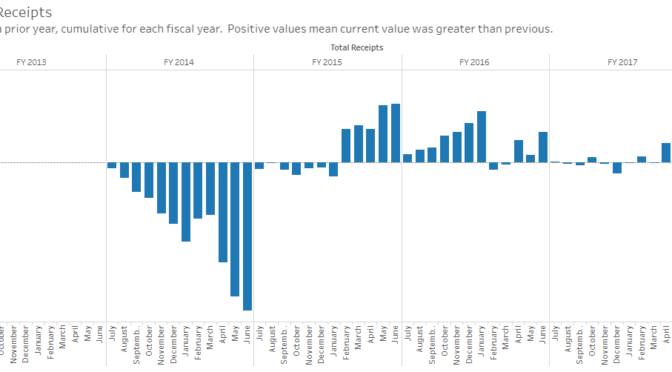

Kansas tax receipts

News about Kansas tax receipts for November 2017, along with an interactive visualization.

-

NOTA a needed voting reform

“None of the Above” voting lets voters cast a meaningful vote, and that can start changing things.

-

WichitaLiberty:TV: Ron and Susan Estes

United States Representative Ron Estes joins Bob Weeks to talk about the tax bill, his op-ed in the Wall Street Journal, and Susan Estes tells us what Mrs. Smith does when Mr. Smith goes to Washington.

-

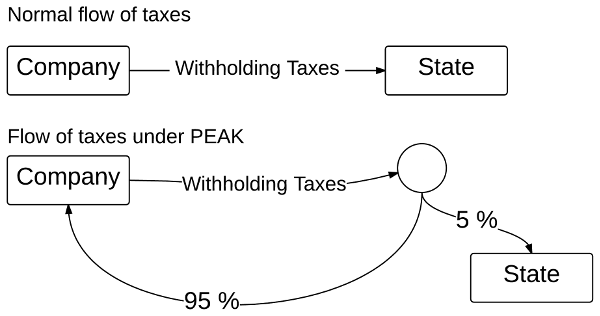

PEAK benefits across Kansas

The use of PEAK, a Kansas economic development incentive program, varies widely among counties.

-

WichitaLiberty.TV: Kansas Representative John Whitmer

Kansas Representative John Whitmer joins Karl Peterjohn and Bob Weeks to discuss current issues in state government, and why he supports Wink Hartman for governor.

-

PEAK, or Promoting Employment Across Kansas

PEAK, a Kansas economic development incentive program, redirects employee income taxes back to the employing company.

-

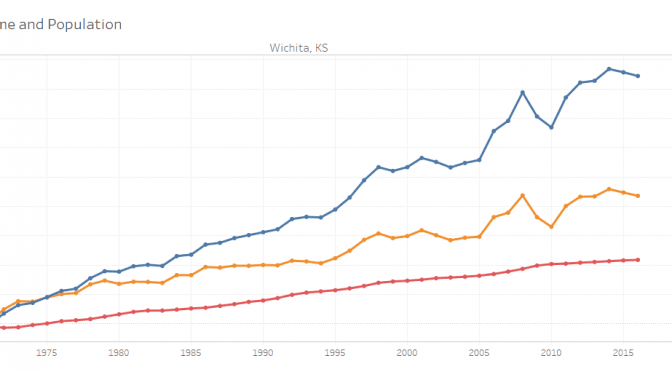

Wichita personal income up, a little

For 2016, personal income in Wichita rose, but is still below 2014 levels.

-

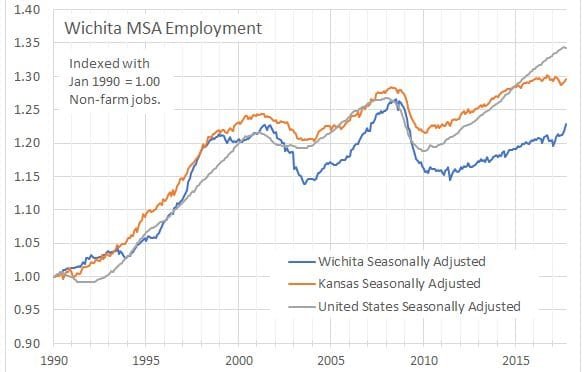

Wichita employment up

Employment in the Wichita metropolitan area is on an upward tick.

-

From Pachyderm: Kansas Senate President Susan Wagle

Kansas Senate President Susan Wagle addressed members and guests of the Wichita Pachyderm Club on November 10, 2017. School finance and the Kansas Supreme Court was a prominent topic.

-

WichitaLiberty.TV: Sedgwick County Commissioner Richard Ranzau

Sedgwick County Commissioner Richard Ranzau joins Karl Peterjohn and Bob Weeks to discuss Sedgwick County government issues, including allegations of misconduct by a commission member and the possibility of a Tyson chicken plant.