Tag: Kansas Policy Institute

-

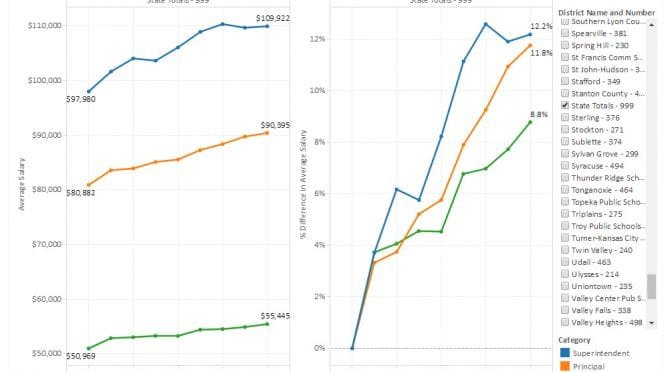

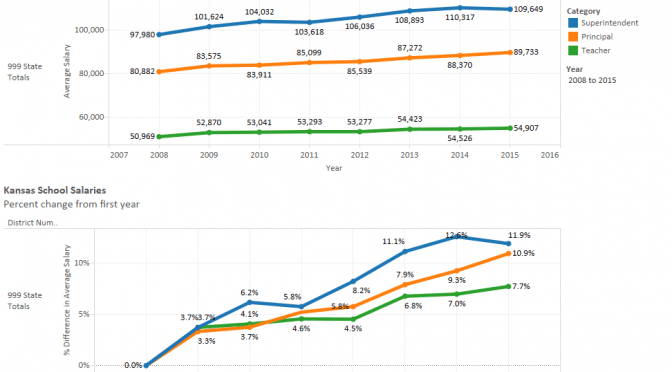

Kansas school salaries

Kansas school salaries for superintendents, principals, and teachers presented in an interactive visualization for each district, updated for 2016 data.

-

Wichita economic development and capacity

An expansion fueled by incentives is welcome, but illustrates a larger problem with Wichita-area economic development.

-

At Pachyderm: Kansas Legislature education chairs to speak

This week the Wichita Pachyderm Club features the chairs of the Kansas Legislature’s two education committees.

-

Math quiz on Kansas spending

The average Kansan is misinformed regarding Kansas school spending, and Kansas news media are to blame, writes Paul Waggoner of Hutchinson

-

Kansas school salaries

Kansas school salaries for superintendents, principals, and teachers presented in an interactive visualization for each district.

-

Kansas school districts compliance with transparency law

Some Kansas school districts are not complying with basic transparency, even though there is a law, finds Kansas Policy Institute.

-

Survey finds Kansans with little knowledge of school spending

As in years past, a survey finds that when Kansans are asked questions about the level of school spending, few have the correct information.

-

CBPP pushes political viewpoint as economic analysis

The Center on Budget & Policy Priorities (CBPP) is at it again, pushing their political viewpoint disguised as economic analysis, writes Dave Trabert of Kansas Policy Institute.

-

Kansas at-risk school funding report released

The Kansas at-risk program, which spent $3.6 billion over the past 23 years, failed its mission to improve the performance of the very students it was designed to serve, finds Kansas Policy Institute.

-

WichitaLiberty.TV: Jonathan Williams of American Legislative Exchange Council

Jonathan Williams of American Legislative Exchange Council (ALEC) explains the goals of ALEC, changes to Kansas tax policy and the results, and the effects of state taxes on charitable giving.

-

Arthur Brooks in Wichita

Arthur C. Brooks, author of “The Conservative Heart,” spoke about being a happy warrior in the conservative movement during the keynote speech of the Annual Awards Dinner of the Kansas Policy Institute.

-

What are opinions of the level of Kansas school spending?

Part of the difficulty in understanding and debating school spending in Kansas is the starting point, that is, the lack of factual information. From 2012, a look at a survey that revealed the level of knowledge of school spending by Kansans.