Tag: Kansas Policy Institute

-

Balancing the Kansas budget

Dave Trabert of the Kansas Policy Institute, spoke on the topic “Debunking False Claims about Kansas Budget and Economy.”

-

Kansas ‘Green Book’ released

Kansas Policy Institute has published a book exploring the relationship between the size of government and economic growth.

-

WichitaLiberty.TV: The Wichita Eagle fails the city and its readers

In this excerpt from WichitaLiberty.TV: In its coverage of the recent election, the Wichita Eagle has failed to inform its readers of city and state issues.

-

WichitaLiberty.TV: Election results, Kansas school employment and spending, and government planning of the economy

In Sedgwick County, an unlikely hero emerges after the November election. Then, what is the trend in Kansas school employment and spending, and what do voters think has happened? Finally, do you know how to make a simple lead pencil?

-

In Kansas, voters want government to concentrate on efficiency and core services before asking for taxes

A survey of Kansas voters finds that Kansas believe government is not operating efficiently. The also believe government should pursue efficiency savings, focus on core functions, and spend unnecessary cash reserves before cutting services or raising taxes.

-

Kansans still uninformed on school spending

As in the past, a survey finds Kansans are uninformed or misinformed on the level of school spending, and also on the direction of its change.

-

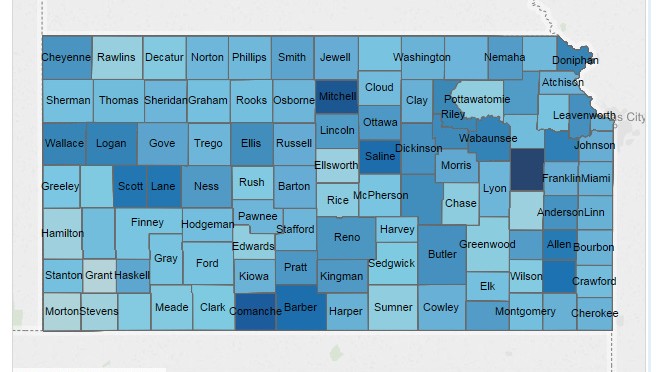

Kansas property tax data, the interactive visualization

Here is an interactive visualization that holds property tax data for Kansas counties from 1997 to 2013.

-

Newspaper editorialists with an ideology? Not in Kansas, surely.

Caution, Kansas newspaper editorialists. Your ideology is showing.

-

For Wichita Eagle, no immediate Kansas budget solution

The Wichita Eagle shows how its adherence to ideology misinforms Kansans and limits their exposure to practical solutions for governance.

-

WichitaLiberty.TV: Dave Trabert of Kansas Policy Institute on the Kansas budget

In this episode of WichitaLiberty.TV: Dave Trabert of Kansas Policy Institute talks about KPI’s recent policy brief “A Five-Year Budget Plan for the State of Kansas: How to balance the budget and have healthy ending balances without tax increases or service reductions.”

-

You, too, may be a Kansas budget analyst

To help Kansans understand the options for future Kansas budgets, Kansas Policy Institute has produced a calculator that lets voters experiment with scenarios of their own making.

-

Voter support of taxpayer-funded economic development incentives

In a poll, about one-third of Wichita voters support local governments using taxpayer money to provide subsidies to certain businesses for economic development.