Tag: Kansas state government

-

Kansas tax revenue, May 2020

For May 2020, total Kansas tax revenue fell by 20 percent from last May.

-

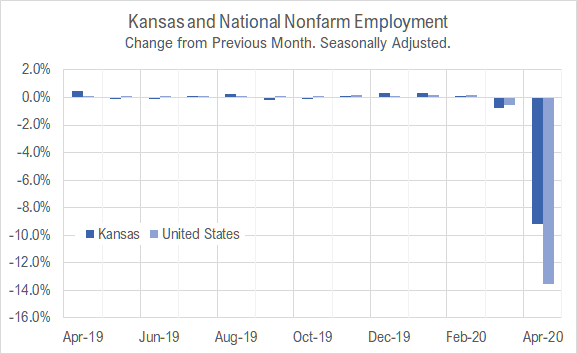

Kansas jobs, April 2020

Employment fell sharply in Kansas in April 2020 as the response to the pandemic unfolded.

-

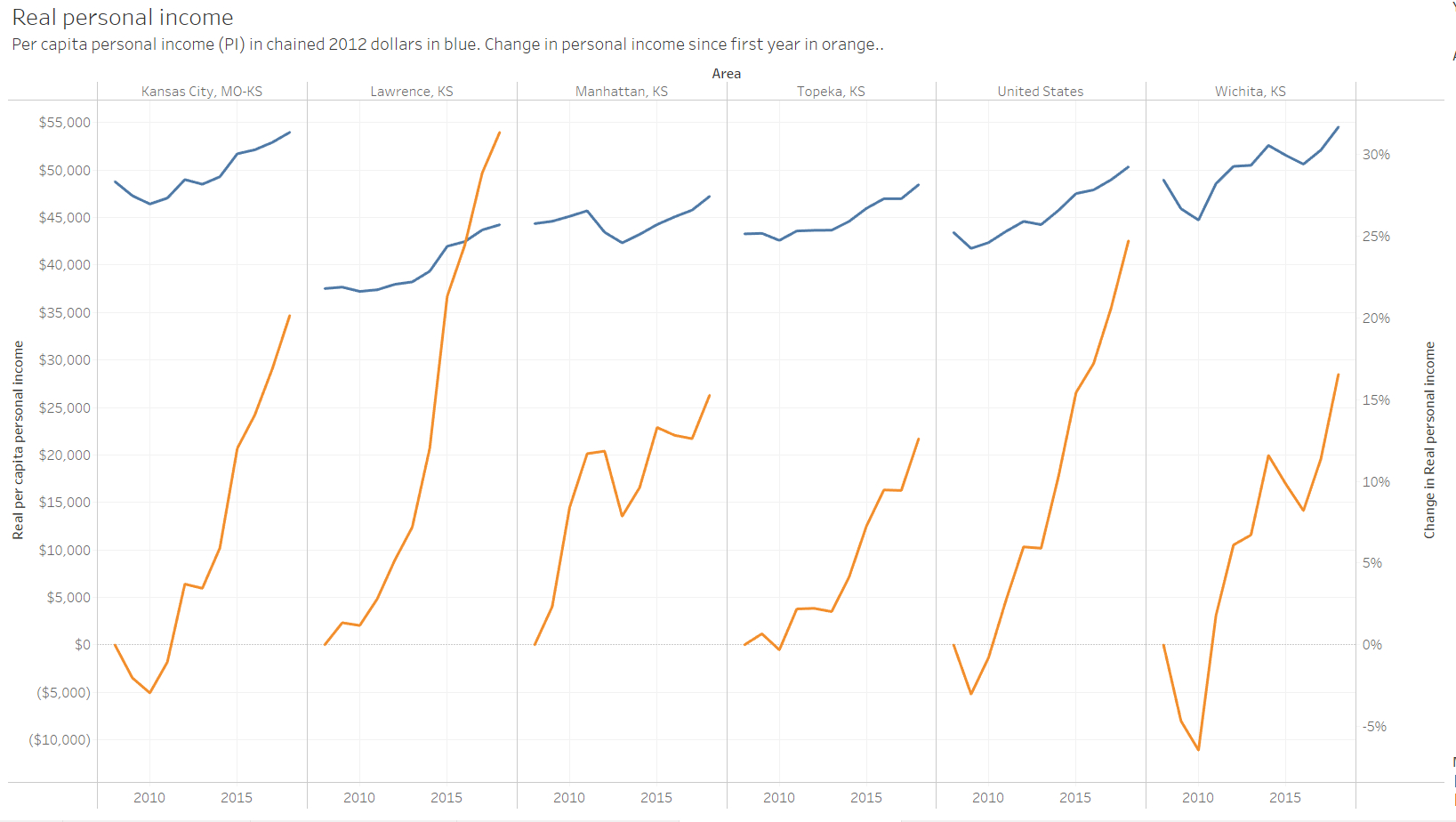

Real personal income in states and metros

When adjusted for regional differences, personal income in Wichita and Kansas is higher than otherwise, but growth is slow.

-

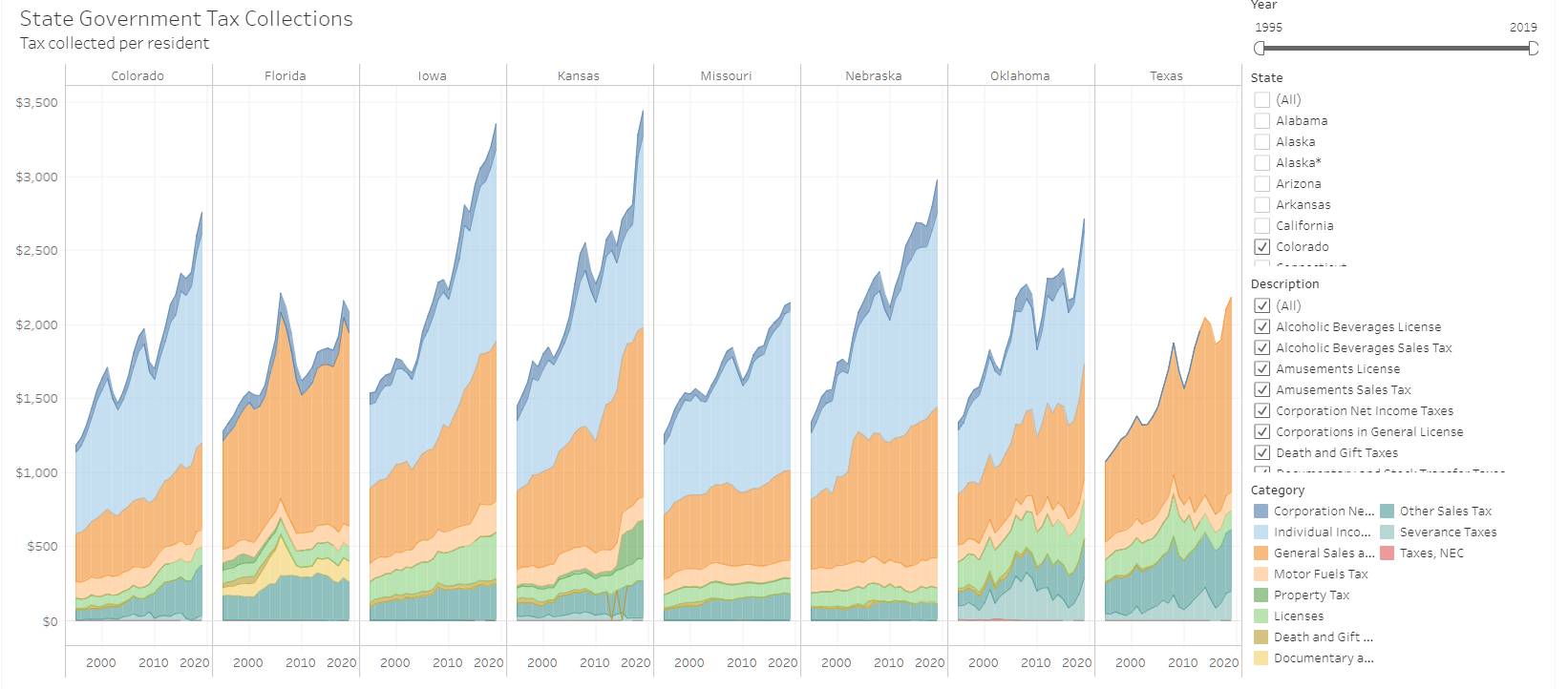

State government tax collections for 2019

Kansas state government tax collections rose to $3,443 per person in 2019, an increase of 5.0 percent from 2018.

-

Kansas tax revenue experiences effects of pandemic response

For April, Kansas retail sales tax collections fell by 8.2 percent from last April, and much income tax revenue is deferred to July.

-

Regulation reform could jump-start Kansas economy after COVID

The COVID-19 outbreak has not only posed a severe public health risk, but actions to combat it now risk a global economic collapse, writes Michael Austin.

-

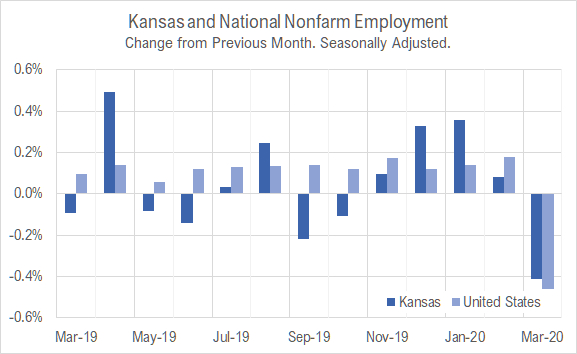

Kansas jobs, March 2020

Employment fell in Kansas in March 2020 compared to the prior month, but it still higher than last March. It is unclear how the pandemic has affected this data

-

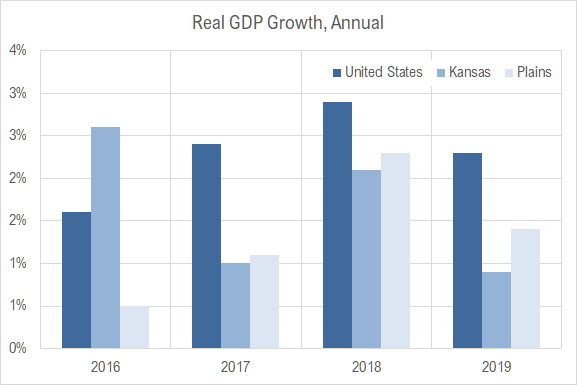

Kansas GDP

In 2019, the Kansas economy grew at the annual rate of 0.9 percent, down from 2.1 percent the previous year, and ranked forty-fifth among the states.

-

Kansas tax revenues not yet affected

Through the end of March 2020, Kansas state tax revenues have not seen the effect of the economic slowdown due to COVID-19.

-

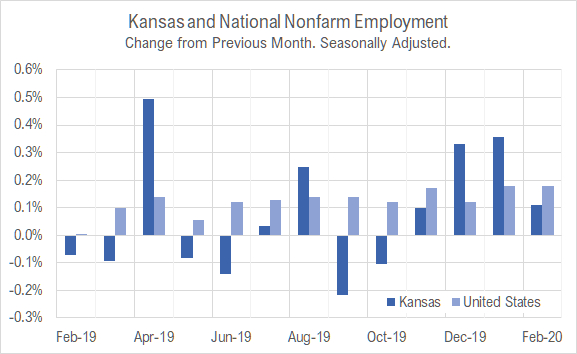

Kansas jobs, February 2020

Employment and the labor force rose in Kansas in February 2020 compared to the prior month, although employment growth was smaller.

-

Kansas personal income

For 2019, the rate of personal income growth in Kansas was near the middle of the states.

-

Kansas jobs, January 2020

Employment and the labor force rose in Kansas in January 2020 compared to the prior month. Kansas outperformed the nation in job growth the past two months.