Tag: Politics

-

Joseph Ashby talks about Wichita Eagle, politics

In this excerpt from the Joseph Ashby Show, the host talks about Wichita Eagle reporting and politics.

-

Competition in markets

Competition must surely be one of the most misunderstood concepts. As applied to economics, government, and markets, the benefits of competition are not understood and valued.

-

Shame, says Wichita Eagle editorial board

The Wichita Eagle editorial board rebukes the Kansas Legislature.

-

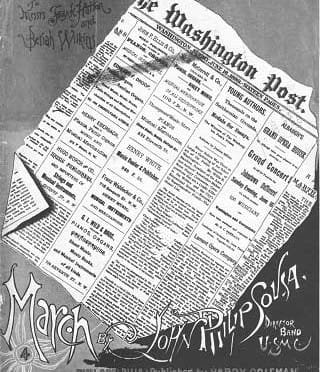

Washington Post out on a limb, again

The Washington Post has published an article that is demonstrably false, and for political reasons.

-

Lashing out at Charles and David Koch, falsely

The attack campaign on Charles and David Koch is a clear sign that Democrats are very worried about November, and they’re lashing out at anyone who’s bankrolling the opposition.

-

State employment visualizations

There’s been dueling claims and controversy over employment figures in Kansas and our state’s performance relative to others. I present the actual data in interactive visualizations that you can use to make up your own mind.

-

In Wichita, citizens want more transparency in city government

In a videographed meeting that is part of a comprehensive planning process, Wichitans openly question the process, repeatedly asking for an end to cronyism and secrecy at city hall.

-

Economic development in Wichita, steps one and two

Critics of the economic development policies in use by the City of Wichita are often portrayed as not being able to see and appreciate the good things these policies are producing, even though they are unfolding right before our very eyes. The difference is that some look beyond the immediate — what is seen –…

-

Voice for Liberty Radio: State of the Republican Party

In this episode of Voice for Liberty Radio: Last fall Bud Norman spoke to a meeting of the Wichita Pachyderm Club.

-

What is the import of the farm bill to Kansas?

Correcting the Wichita Eagle’s facts will place the importance of the farm bill to Kansas in proper perspective.

-

Voice for Liberty Radio: David Boaz of Cato Institute

In this episode of WichitaLiberty Radio: David Boaz spoke at the annual Kansas Policy Institute Dinner.

-

Voice for Liberty Radio: Milton Wolf

In this episode of Voice for Liberty Radio: Dr. Milton Wolf is a candidate for United States Senate and will face incumbent Pat Roberts in the August primary election. We spoke by telephone on January 23, 2014.