Here are highlights from Voice for Liberty for 2016. Was it a good year for the principles of individual liberty, limited government, economic freedom, and free markets in Wichita and Kansas?

Also be sure to view the programs on WichitaLiberty.TV for guests like journalist, novelist, and blogger Bud Norman; Radio talk show host Joseph Ashby; David Bobb, President of Bill of Rights Institute; Heritage Foundation trade expert Bryan Riley; Radio talk show host Andy Hooser; Keen Umbehr; John Chisholm on entrepreneurship; James Rosebush, author of “True Reagan,” Jonathan Williams of American Legislative Exchange Council (ALEC); Gidget Southway, or Danedri Herbert; Lawrence W. Reed, president of the Foundation for Economic Education; and Congressman Mike Pompeo.

January

Kansas legislative resources. Citizens who want to be informed of the happenings of the Kansas Legislature have these resources available.

School choice in Kansas: The haves and have-nots. Kansas non-profit executives work to deny low-income families the school choice opportunities that executive salaries can afford.

Kansas efficiency study released. An interim version of a report presents possibilities of saving the state $2 billion over five years.

Wichita Eagle Publisher Roy Heatherly. Wichita Eagle Publisher Roy Heatherly spoke to the Wichita Pachyderm Club on January 15, 2016. This is an audio presentation.

Pupil-teacher ratios in the states. Kansas ranks near the top of the states in having a low pupil-teacher ratio.

Kansas highway conditions. Has continually “robbing the bank of KDOT” harmed Kansas highways?

Property rights in Wichita: Your roof. The Wichita City Council will attempt to settle a dispute concerning whether a new roof should be allowed to have a vertical appearance rather than the horizontal appearance of the old.

Must it be public schools? A joint statement released by Kansas Association of School Boards, United School Administrators of Kansas, Kansas School Superintendents’ Association, and Kansas National Education Association exposes the attitudes of the Kansas public school establishment.

Kansas schools and other states. A joint statement released by Kansas Association of School Boards, United School Administrators of Kansas, Kansas School Superintendents’ Association, and Kansas National Education Association makes claims about Kansas public schools that aren’t factual.

After years of low standards, Kansas schools adopt truthful standards. In a refreshing change, Kansas schools have adopted realistic standards for students, but only after many years of evaluating students using low standards.

Brownback and Obama stimulus plans. There are useful lessons we can learn from the criticism of Kansas Governor Sam Brownback, including how easy it is to ignore inconvenient lessons of history.

February

Spending and taxing in Kansas. Difficulty balancing the Kansas budget is different from, and has not caused, widespread spending cuts.

In Sedgwick County, choosing your own benchmarks. The Sedgwick County Commission makes a bid for accountability with an economic development agency, but will likely fall short of anything meaningful.

This is why we must eliminate defined-benefit public pensions. Actions considered by the Kansas Legislature demonstrate — again — that governments are not capable of managing defined-benefit pension plans.

Kansas transportation bonds economics worse than told. The economic details of a semi-secret sale of bonds by the State of Kansas are worse than what’s been reported.

Massage business regulations likely to be ineffective, but will be onerous. The Wichita City Council is likely to create a new regulatory regime for massage businesses in response to a problem that is already addressed by strict laws.

Inspector General evaluates Obamacare website. The HHS Inspector General has released an evaluation of the Obamacare website HealthCare.gov, shedding light on the performance of former Kansas Governor Kathleen Sebelius.

Kansas highway spending. An op-ed by an advocate for more highway spending in Kansas needs context and correction.

Brookings Metro Monitor and Wichita. A research project by The Brookings Institution illustrates the poor performance of the Wichita-area economy.

March

Wichita: A conversation for a positive community and city agenda. Wichita City Manager Robert Layton held a discussion titled “What are Wichita’s Strengths and Weaknesses: A Conversation for a Positive Community and City Agenda” at the February 26, 2016 luncheon of the Wichita Pachyderm Club.

In Kansas, teachers unions should stand for retention. A bill requiring teachers unions to stand for retention elections each year would be good for teachers, students, and taxpayers.

In Kansas, doctors may “learn” just by doing their jobs. A proposed bill in Kansas should make us question the rationale of continuing medical education requirements for physicians.

Power of Kansas cities to take property may be expanded. A bill working its way through the Kansas Legislature will give cities additional means to seize property.

Wichita TIF district disbands; taxpayers on the hook. A real estate development in College Hill was not successful. What does this mean for city taxpayers?

Kansas and Colorado, compared. News that a Wichita-based company is moving to Colorado sparked a round of Kansas-bashing, most not based on facts.

In Wichita, the phased approach to water supply can save a bundle. In 2014 the City of Wichita recommended voters spend $250 million on a new water supply. But since voters rejected the tax to support that spending, the cost of providing adequate water has dropped, and dropped a lot.

Wichita Eagle, where are you? The state’s largest newspaper has no good reason to avoid reporting and editorializing on an important issue. But that’s what the Wichita Eagle has done.

April

Wichita on verge of new regulatory regime. The Wichita City Council is likely to create a new regulatory regime for massage businesses in response to a problem that is already addressed by strict laws.

Wichita economic development and capacity. An expansion fueled by incentives is welcome, but illustrates a larger problem with Wichita-area economic development.

Rich States, Poor States, 2106 edition. In Rich States, Poor States, Kansas continues with middle-of-the-pack performance, and fell sharply in the forward-looking forecast.

In Wichita, revealing discussion of property rights. Reaction to the veto of a bill in Kansas reveals the instincts of many government officials, which is to grab more power whenever possible.

‘Trump, Trump, Trump’ … oops! An event in Wichita that made national headlines has so far turned out to be not the story news media enthusiastically promoted.

Wichita doesn’t have this. A small Kansas city provides an example of what Wichita should do.

Kansas continues to snub school choice reform that helps the most vulnerable schoolchildren. Charter schools benefit minority and poor children, yet Kansas does not leverage their benefits, despite having a pressing need to boost the prospects of these children.

Wichita property tax rate: Up again. The City of Wichita says it hasn’t raised its property mill levy in many years. But data shows the mill levy has risen, and its use has shifted from debt service to current consumption.

AFP Foundation wins a battle for free speech for everyone. Americans for Prosperity Foundation achieves a victory for free speech and free association.

Kansas Center for Economic Growth. Kansas Center for Economic Growth, often cited as an authority by Kansas news media and politicians, is not the independent and unbiased source it claims to be.

Under Goossen, Left’s favorite expert, Kansas was admonished by Securities and Exchange Commission. The State of Kansas was ordered to take remedial action to correct material omissions in the state’s financial statements prepared under the leadership of Duane Goossen.

May

Spirit Aerosystems tax relief. Wichita’s largest employer asks to avoid paying millions in taxes, which increases the cost of government for everyone else, including young companies struggling to break through.

Wichita mayor’s counterfactual op-ed. Wichita’s mayor pens an op-ed that is counter to facts that he knows, or should know.

Electioneering in Kansas?. An op-ed written under the banner of a non-profit organization appears to violate the ban on electioneering.

Wichita city council campaign finance reform. Some citizen activists and Wichita city council members believe that a single $500 campaign contribution from a corporation has a corrupting influence. But stacking dozens of the same $500 contributions from executives and spouses of the same corporation? Not a problem.

In Wichita, more sales tax hypocrisy. Another Wichita company that paid to persuade you to vote for higher taxes now seeks to avoid paying those taxes.

Wichita student/teacher ratios. Despite years of purported budget cuts, the Wichita public school district has been able to improve its student/teacher ratios.

June

KPERS payments and Kansas schools. There is a claim that a recent change in the handling of KPERS payments falsely inflates school spending. The Kansas State Department of Education says otherwise.

Regulation in Wichita, a ‘labyrinth of city processes’. Wichita offers special regulatory treatment for special circumstances, widening the gulf between the haves and have-nots.

They really are government schools. What’s wrong with the term “government schools?”

July

Kansas City Star as critic, or apologist. An editorial in the Kansas City Star criticizes a Kansas free-market think tank.

State and local government employee and payroll. Considering all state and local government employees in proportion to population, Kansas has many, compared to other states, and especially so in education.

Kansas government ‘hollowed-out’. Considering all state and local government employees in proportion to population, Kansas has many, compared to other states, and especially so in education.

In Wichita, Meitzner, Clendenin sow seeds of distrust. Comments by two Wichita city council members give citizens more reasons to be cynical and distrusting of politicians.

David Dennis, gleeful regulatory revisionist. David Dennis, candidate for Sedgwick County Commission, rewrites his history of service on the Kansas State Board of Education.

Say no to Kansas taxpayer-funded campaigning. Kansas taxpayers should know their tax dollars are helping staff campaigns for political office.

Roger Marshall campaign setting new standards. Attacks on Tim Huelskamp reveal the worst in political campaigning.

Wichita Metro Chamber of Commerce on the campaign trail. We want to believe that The Wichita Metro Chamber of Commerce and its PAC are a force for good. Why does the PAC need to be deceptive and untruthful?

August

Which Kansas Governor made these proposals?. Cutting spending for higher education, holding K through 12 public school spending steady, sweeping highway money to the general fund, reducing aid to local governments, spending down state reserves, and a huge projected budget gap. Who and when is the following newspaper report referencing?

Wichita Business Journal editorial missed the news on the Wichita economy. A Wichita business newspaper’s editorial ignores the history of our local economy. Even the history that it reported in its own pages.

Sedgwick County Health Department: Services provided. Sedgwick County government trimmed spending on health. What has been the result so far?

School staffing and students. Trends for the nation and each state in teachers, administrators, and students, presented in an interactive visualization.

Intrust Bank Arena loss for 2015 is $4.1 million. The depreciation expense of Intrust Bank Arena in downtown Wichita recognizes and accounts for the sacrifices of the people of Sedgwick County and its visitors to pay for the arena.

School spending in the states. School spending in the states, presented in an interactive visualization.

September

Kansas construction employment. Tip to the Wichita Eagle editorial board: When a lobbying group feeds you statistics, try to learn what they really mean.

Wichita has no city sales tax, except for these. There is no Wichita city retail sales tax, but the city collects tax revenue from citizens when they buy utilities, just like a sales tax.

CID and other incentives approved in downtown Wichita. The Wichita City Council approves economic development incentives, but citizens should not be proud of the discussion and deliberation.

Cost per visitor to Wichita cultural attractions. Wichitans might be surprised to learn the cost of cultural attractions.

GetTheFactsKansas launched. From Kansas Policy Institute and the Kansas Chamber of Commerce, a new website with facts about the Kansas budget, economy, and schools.

The nation’s report card and charter schools.

* An interactive table of NAEP scores for the states and races, broken down by charter school and traditional public school.

* Some states have few or no charter schools.

* In many states, minority students perform better on the NAEP test when in charter schools.

School choice and funding. Opponents of school choice programs argue the programs harm traditional public schools, both financially and in their ability to serve their remaining students. Evidence does not support this position.

October

Public school experts. Do only those within the Kansas public schooling community have a say?

Kansas and Arizona schools. Arizona shows that Kansas is missing out on an opportunity to provide better education at lower cost.

Video in the Kansas Senate. A plan to increase visibility of the Kansas Senate is a good start, and needs to go just one or two steps farther.

Kansas, a frugal state?. Is Kansas a frugal state, compared to others?

Topeka Capital-Journal falls for a story. The editorial boards of two large Kansas newspapers have shown how little effort goes into forming the opinions they foist upon our state.

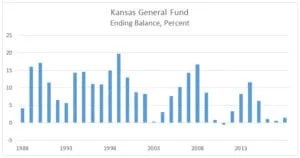

Kansas revenue estimates. Kansas revenue estimates are frequently in the news and have become a political issue. Here’s a look at them over the past decades.

Kansas school fund balances.

* Kansas school fund balances rose significantly this year, in both absolute dollars and dollars per pupil.

* Kansans might wonder why schools did not spend some of these funds to offset cuts they have contended were necessary.

* The interactive visualization holds data for each district since 2008.

In Wichita, developer welfare under a cloud. A downtown Wichita project receives a small benefit from the city, with no mention of the really big money.

Wichita, give back the Hyatt proceeds. Instead of spending the proceeds of the Hyatt hotel sale, the city should honor those who paid for the hotel — the city’s taxpayers.

Kansas Democrats: They don’t add it up — or they don’t tell us. Kansas Democrats (and some Republicans) are campaigning on some very expensive programs, and they’re aren’t adding it up for us.

November

How would higher Kansas taxes help?. Candidates in Kansas who promise more spending ought to explain just how higher taxes will — purportedly — help the Kansas economy.

Decoding the Kansas teachers union. Explaining to Kansans what the teachers union really means in its public communications.

Kansas school spending: Visualization. An interactive visualization of revenue and spending data for Kansas school districts.

Decoding Duane Goossen. The writing of Duane Goossen, a former Kansas budget director, requires decoding and explanation. This time, his vehicle is “Rise Up, Kansas.”

Decoding the Kansas teachers union. Decoding and deconstructing communications from KNEA, the Kansas teachers union, lets us discover the true purpose of the union.

Government schools’ entitlement mentality. If the Kansas personal income grows, should school spending also rise?

December

Wichita bridges, well memorialized. Drivers on East Twenty-First Street in Wichita are happy that the work on a small bridge is complete, but may not be pleased with one aspect of the project.

Gary Sherrer and Kansas Policy Institute. A former Kansas government official criticizes Kansas Policy Institute.

Wichita to grant property and sales tax relief. Several large employers in Wichita ask to avoid paying millions in taxes, which increases the cost of government for everyone else, including young companies struggling to break through.

Economic development incentives at the margin. The evaluation of economic development incentives in Wichita and Kansas requires thinking at the margin, not the entirety.

The Wichita economy, according to Milken Institute. The performance of the Wichita-area economy, compared to other large cities, is on a downward trend.

State pension cronyism. A new report details the way state pension funds harm workers and taxpayers through cronyism.

In Wichita, converting a hotel into street repairs. In Wichita, it turns out we have to sell a hotel in order to fix our streets.

In Wichita, we’ll not know how this tax money is spent. Despite claims to the contrary, the attitude of the City of Wichita towards citizens’ right to know is poor, and its attitude will likely be reaffirmed this week.

From the

From the