Reaction to the veto of a bill in Kansas reveals the instincts of many government officials, which is to grab more power whenever possible.

— Frederic Bastiat

Kansas Governor Sam Brownback’s veto of a bill that gives cities additional means to take blighted property has produced reaction from local officials in Wichita. The bill is Senate Bill 338.

As has been noted in numerous sources, cities in Kansas have many tools available to address blight. 1 What is the purported need for additional power?

In remarks from the bench, Wichita City Council Member Pete Meitzner (district 2, east Wichita) said there is no intent to be “aggressive in taking people’s property.” 2 But expanding the power of government — aggression, in other words — is what the bill does. Otherwise, why the need for the bill with its new methods and powers of taking property?

And once government is granted new powers, government nearly always finds ways to expand the power and put it to new uses. Even if we believe Meitzner — and we should not — he will not always be in office. Others will follow him who may not claim to be so wise and restrained in the use of government power.

In particular, government finds new ways to expand its powers through enabling concepts like blight. Did you know the entire suburban town of Andover is blighted? 3 Across the country, when governments find they can take property with novel and creative interpretations of blight, they do so. 4

It’s easy to sense the frustration of government officials like Wichita Mayor Jeff Longwell. In his remarks, he asked opponents of SB 338 “what they would do” when confronted with blight. That is a weak argument, but is often advanced nonetheless. Everyone has the right — the duty — to oppose bad legislation even if they do not have an alternate solution. Just because someone doesn’t have a solution, that doesn’t mean their criticism is not valid. This is especially true in this matter, as cities already have many tools to deal with blight.

Proponents of SB 338 also make unfounded accusations about the motivation of opponents of the law. Because someone opposes this law, it doesn’t mean they are in favor of more blight. Those who fight for freedom and liberty are used to this. Advocating for the right to do something doesn’t necessarily mean that one is in favor of actually doing it.

The nature of rights

Much of the discussion this issue concerns the rights of people who live near blighted property. People do have certain rights, but rights have limits. Regarding property, Roger Pilon writes: “Thus, uses that injure a neighbor through various forms of pollution (e.g., by particulate matter, noises, odors, vibrations, etc.) or through exposure to excessive risk count as classic common-law nuisances because they violate the neighbor’s rights. They can be prohibited, with no compensation owing to those who are thus restricted.” 5

Note that Pilon mentions “excessive risk” as something that injures a neighbor. Some of the activities the city wants to control are things like drug dealing, drug usage, and prostitution that may take place on blighted property. And, I suppose it is a risk to have gangs dealing drugs out of the house across the street, blighted or not. But these activities are illegal everywhere, and there are many laws the city can use to control these problems. There is no need for new laws.

It is important to draw a bright line as to where property rights end. Pilon: “By contrast, uses that ‘injure’ one’s neighbor through economic competition, say, or by blocking ‘his’ view (which runs over your property) or offending his aesthetic sensibilities are not nuisances because they violate no rights the neighbor can claim. Nor will it do to simply declare, through positive law, that such goods are ‘rights.’” 6

In today’s world, however, where new rights are seemingly created from thin air, people want to exercise their purported right to control how their neighbor’s property looks. But we have no such right, writes Pilon: “The principle, in fact, is just this: People may use their property in any way they wish, provided only that in the process they do not take what belongs free and clear to others. My neighbor’s view that runs over my property does not belong free and clear to him.” 7

Opposition in the Legislature

When the Kansas House of Representatives and Senate voted on this bill, several House members submitted explanations of their vote. In the Senate, David Haley filed a protest and message explaining his opposition to the bill. These statements follow.

Explanation of vote in the House of Representatives

MR. SPEAKER: I VOTE NO ON SB 338. KANSAS ALREADY HAS SUFFICIENT TOOLS IN PLACE TO ADDRESS BLIGHT. SB 338 circumvents our current eminent domain statutes by redefining “abandoned property” and by allowing our local governments to expeditiously confiscate, seize or destroy law abiding citizens’ private property without compensation, adequate notice, and a legal property title. This is an egregious overreach that deprives some citizens of their private property rights without sufficient due process and it will cause irreparable harm to our most vulnerable citizens that do not have the resources to protect their property.

— GAIL FINNEY, BRODERICK HENDERSON, RODERICK HOUSTON, BEN SCOTT, VALDENIA WINN, JOHN CARMICHAEL, KASHA KELLEY, BILL SUTTON, JERRY LUNN, CHARLES MACHEERS

Protest of Senator David Haley against Senate Bill 338

February 23, 2016

In Accordance with Article 2, Section 10 of the Constitution of Kansas, I, David Haley, a duly elected Senator representing the Fourth District of Kansas, herein PROTEST the action of this Legislature in the promulgation and passage of Senate Bill 338: An Act pertaining to Cities.

In my 23 years as a Kansas Legislator and as but one of only three attorneys in the Senate, this is the first PROTEST I have ever lodged on any measure of the thousands I have considered.

This Chamber now further denigrates real property rights to which every Kansan should be heir.

SB 338 which purports to grant authority to cities and nonprofit organizations to petition courts to possess vacant property for rehabilitation purposes will, simply, but legalize grand theft.

The Senate Commerce committee as is its charge (and not the Senate Local Government committee where, justifiably, similar language as SB 338 had over many years failed time and time again) recognizes and advances business and financial opportunities for our State.

First, the question of a city, redefining definitions of “abandonment” and “blight” as these terms apply to real property, land and or improvements, is the expertise of deliberations of a committee membership dedicated to the auspices of municipalities not the principles of profit.

The principles of real property ownership should always inure to the rights of the citizen not to a developer’s bottom line or even a desire to enhance appraised valuations for tax purposes.

Diabolical in its spawning, methodical and tenacious in its steady lurch forward, SB 338 adheres to two tiered definitions of “abandoned property;” both ingenuous and neither accurate. One definition of “abandoned property”: vacant for 365 days and having a “blighting influence” on surrounding properties; the other definition vacant for 90 days and 2 years tax delinquent.

There are numerous every day scenarios whereby a real property owner has in no way “abandoned” their property though that same property may be vacant for 90 to 365 days, be tax delinquent for 2 years or may have need of rehabilitation to conform to a local standard, real or perceived. But SB 338 alleges “abandonment” and triggers governmental intrusion, harassment and potentially leads to a taking of real property by the government for the benefit of an organization which profits from the taking and kick back higher taxes to the city.

“Commerce,” yes, but a shameful way to run a citizen responsive “Local Government.”

The specious argument in favor of this legislation portends neighborhood beautification, tax viability and repopulation of or demolition and rebuilding of older houses. By eradicating “blight,” the entire community, even the city, is greatly enhanced.

With that premise, I, David Haley, could not agree more.

Today, with no need for warping and putting into statute time-honored definitions of “blight” and “abandonment” or presupposes new postulates for passages of time periods to correlate to real property owners’ interests or genuine concern with their legally owned land(s), there are tools already available to every municipality to address blight. “Code enforcement” departments can post notice and bring to environmental and district court negligent property owners. Subsequent to insufficient response, steep fines and even jail time can be issued now. Today in current statute, a property with two or more years of delinquent property taxes may be sold by the Sheriff of each Kansas County in a “Delinquent Property Tax Sale” also known as a “Sheriff’s” sale or as property “sold on the Courthouse steps.” Again, these are current tools available to curb or cure blight and to put real property into fiscally responsive ownership.

The property rights of legal property owners should not be infringed upon by this Legislature.

Marginal or fragile property owners (traditionally average income or poor property owners attempting to hold on to inherited property or an entrepreneurial hope structure as often found in inner cities) will be set upon by keen-eyed, out of county based developers sheltered by an industrious “not-for-profit” which uses the city and district court as the leverage to harass and ultimately take the land, all in the name of “civic pride” or “community betterment.” Theft.

The late Kansas City, Missouri civil rights leader Bernard Powell (1947-1979) envisioned and warned of the transfer of inner city property back into the same hands of those who fled the same a half century or more ago to the sanctity of the suburbs. Bernard Powell predicted the day would come when government, and the tools they elect and hire, will work hand-in-hand with “robber barons” to turn those out; those who have despaired in neglected, under represented, often high crime, poorly educated neighborhoods, those who have weathered poverty, hard times, civic and civil harassment but yet held a real property interest, a “piece of the pie” … to force them out. Bernard Powell spoke of prosperity returning to the inner city and nothing being tendered to the people who had paid the price for the most sought after of land.

He called it government assisting the turning of the “ghetto into a goldmine.” How prophetic.

Here I sit, practically alone in my opposition to this expansion of eminent domain targeted at poorer property owners ill equipped to “fight City Hall,” in this Kansas Senate and watch this unfold. Again, SB 338 came out of the Commerce committee as well it should.

Government has redefined terms before to shape shift often dastardly need to justify ill deeds.

I remember efforts to redefine “blight” for economic purposes in another eminent domain taking for use in building the Kansas Speedway and Legends in Wyandotte County. Succinctly, the new definition of “blight” was the ability for exponentially more taxes to be levied against the future use of the land than that which the owner who it was being taken from could be expected to pay in its current use. Remnants of that economically fascist philosophy resonate in SB 338. As more people flee the “golden ghettos” of suburbia, the inner city “ghettos” will be repopulated and turned into “goldmines” at the expense I fear, once again, of the poor and unsuspecting. Ironically, we celebrated and honored some of our Korean and Vietnam War heroes today in the Senate Chamber. Was the freedom to own real property without fear of unwarranted government intrusion something for which they fought?

I protest the passage of Senate Bill 338 as is my Constitutional right as a Kansas State Senator under Article Two, Section 10 of the Kansas Constitution for reasons, beliefs afore-listed as well as others not so and hereby vow to continue to assist unnecessarily embattled real property owners in my home District as we together will face the challenges that this bill, when signed into law, will undoubtedly bring.

—

Notes

- Todd, John. Power of Kansas cities to take property may be expanded. Voice For Liberty in Wichita. Available at wichitaliberty.org/kansas-government/power-kansas-cities-take-property-may-expanded/. ↩

- Video. Wichita City Council speaks on blight. Available at wichitaliberty.org/wichita-government/wichita-city-council-speaks-blight/. ↩

- Weeks, B. (2012). Andover, a Kansas city overtaken by blight. Voice For Liberty in Wichita. Available at wichitaliberty.org/economics/andover-a-kansas-city-overtaken-by-blight/. ↩

- Nicole Gelinas, Eminent Domain as Central Planning. (2015). City Journal. Available at www.city-journal.org/html/eminent-domain-central-planning-13253.html. ↩

- Pilon, Roger. Protecting Private Property Rights from Regulatory Takings. (1995). Cato Institute. Available at www.cato.org/publications/congressional-testimony/protecting-private-property-rights-regulatory-takings. ↩

- ibid ↩

- ibid ↩

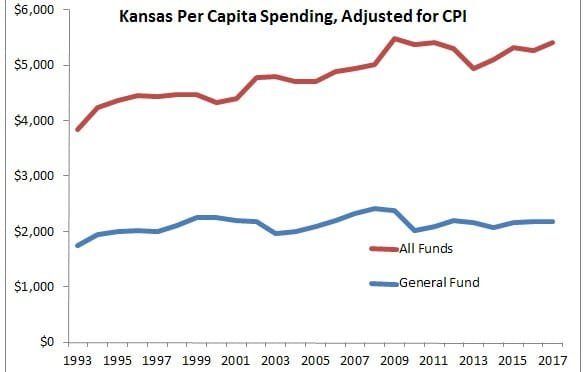

First, Dunphy refers to Sam Brownback as the “Tea Party” governor of Kansas. As far as I know, the tea party favors reducing not only taxation, but spending too. Given the choice, Brownback preferred raising taxes rather than cutting spending. Not very tea party-like.

First, Dunphy refers to Sam Brownback as the “Tea Party” governor of Kansas. As far as I know, the tea party favors reducing not only taxation, but spending too. Given the choice, Brownback preferred raising taxes rather than cutting spending. Not very tea party-like.