Tag: Sam Brownback

-

Kansas school spending, according to the Telegram

Another Kansas newspaper editorial shows that when writing about Kansas school spending, facts are sometimes not observed.

-

Kansas school test scores, the subgroups

To understand Kansas school test scores, look at subgroups.

-

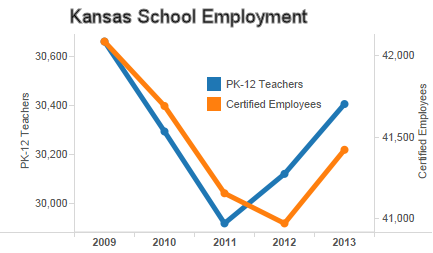

Kansas school employment: The claims compared to statistics

Claims made about Kansas schools don’t match the state’s statistics.

-

Job claims in Kansas addresses

How can conflicting jobs claims made by two Kansas leaders and candidates for governor be reconciled?

-

Kansas schoolchildren shortchanged by Kansas City Star

Another newspaper editorialist ignores the facts about Kansas schools. This is starting to be routine.

-

Kansas trails surrounding states in economic freedom

In a recent study of economic freedom in North America, Kansas ranked in the middle of the pack nationwide, but trails most surrounding states.

-

2013 year in review: Top 10 stories from the Sunflower State

It’s over, done, finalized, finito. With the final days and hours of 2013 ticking to a close, we figured it’s a good time for reflection on what the last 12 months have brought the Sunflower State.

-

Job growth, Kansas and other states

Critics of Kansas Governor Sam Brownback may not know that Kansas has produced substandard performance in job growth for a long time.

-

In Kansas, dueling job claims

Candidates for Kansas governor last week released statements on recent job figures in Kansas. The releases from Sam Brownback and Paul Davis appear to contain conflicting views of Kansas employment.

-

Spinning for fundraising, Kansas-style

Kansas liberals accuse Republicans of “spinning” statistics on school funding. Can we look at some actual numbers?

-

Kansas school logic, Goddard-style

Data from KSDE shows that the Goddard school district has increased the number of teachers and other certified employees in recent years, and the corresponding ratios of these employees to students has fallen.