Category: Kansas state government

-

Kansas Tax Revenue, July 2022

For July 2022, Kansas tax revenue was 2.7 percent less than July 2021. There are special circumstances.

-

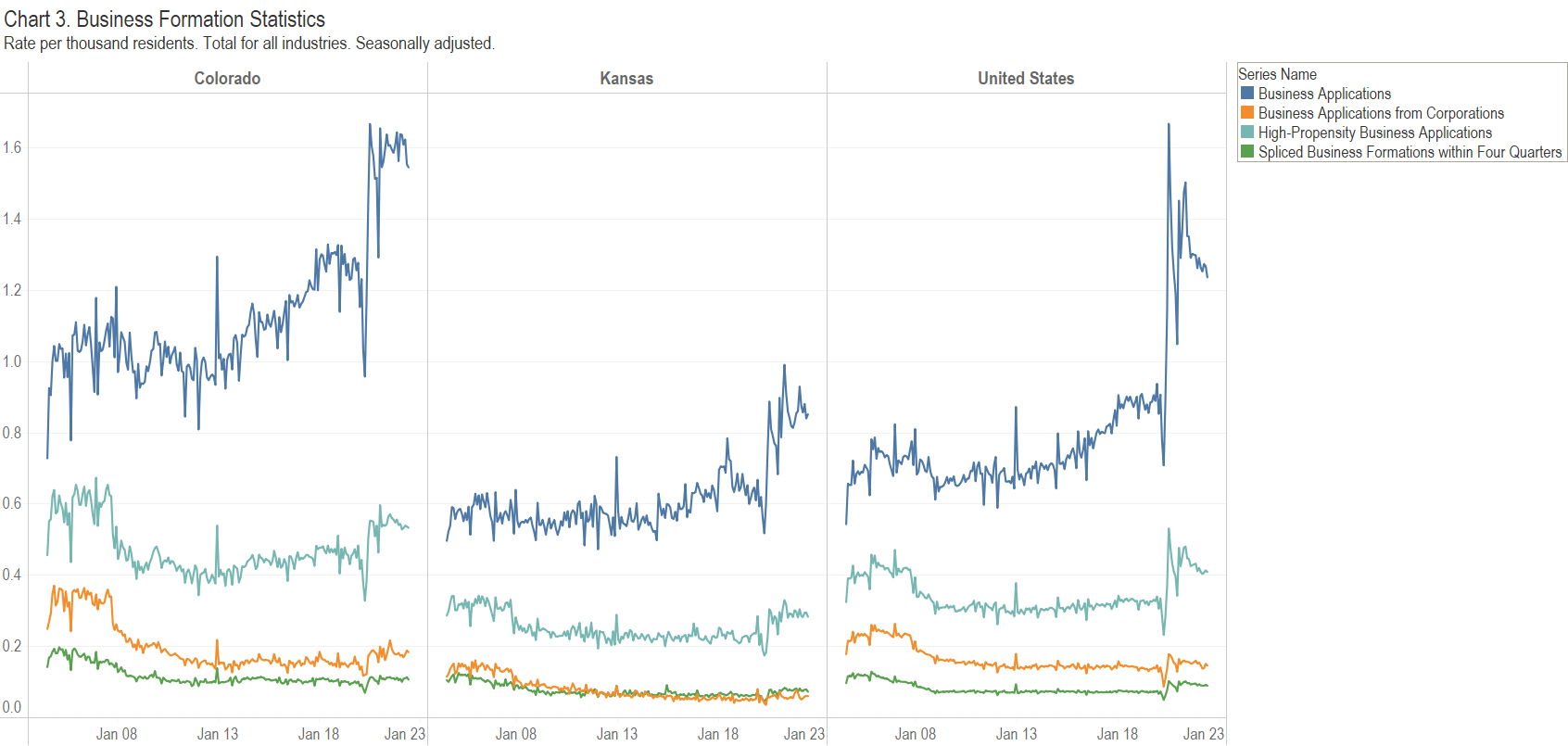

Business Formation in Kansas

For both business applications and business formations, Kansas lags many states and the nation.

-

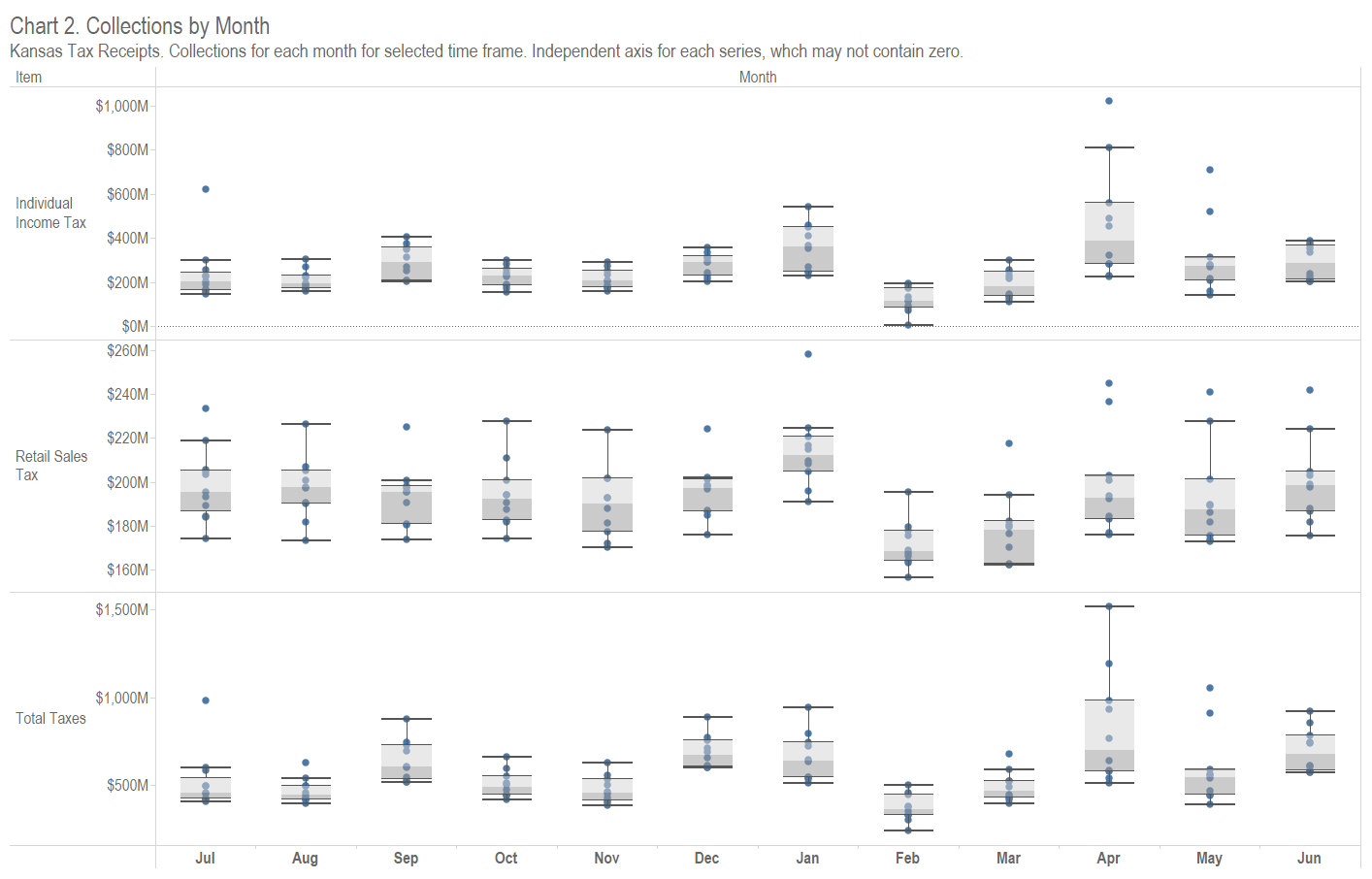

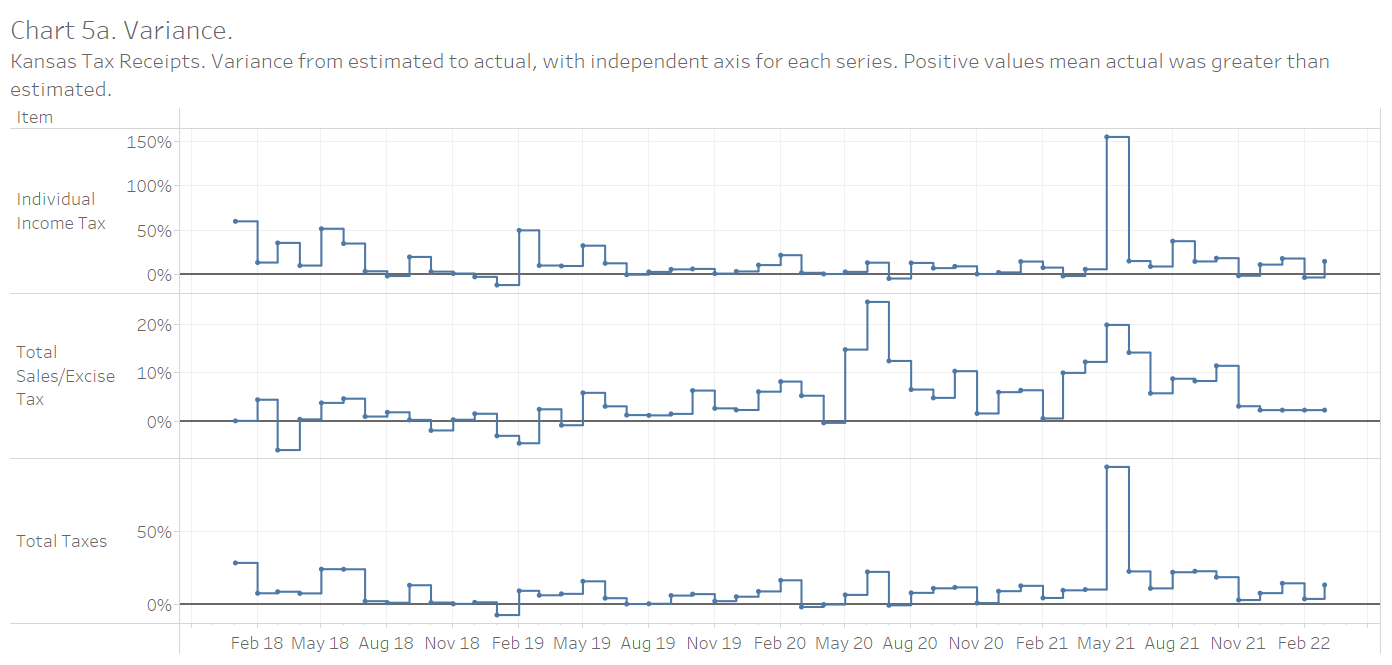

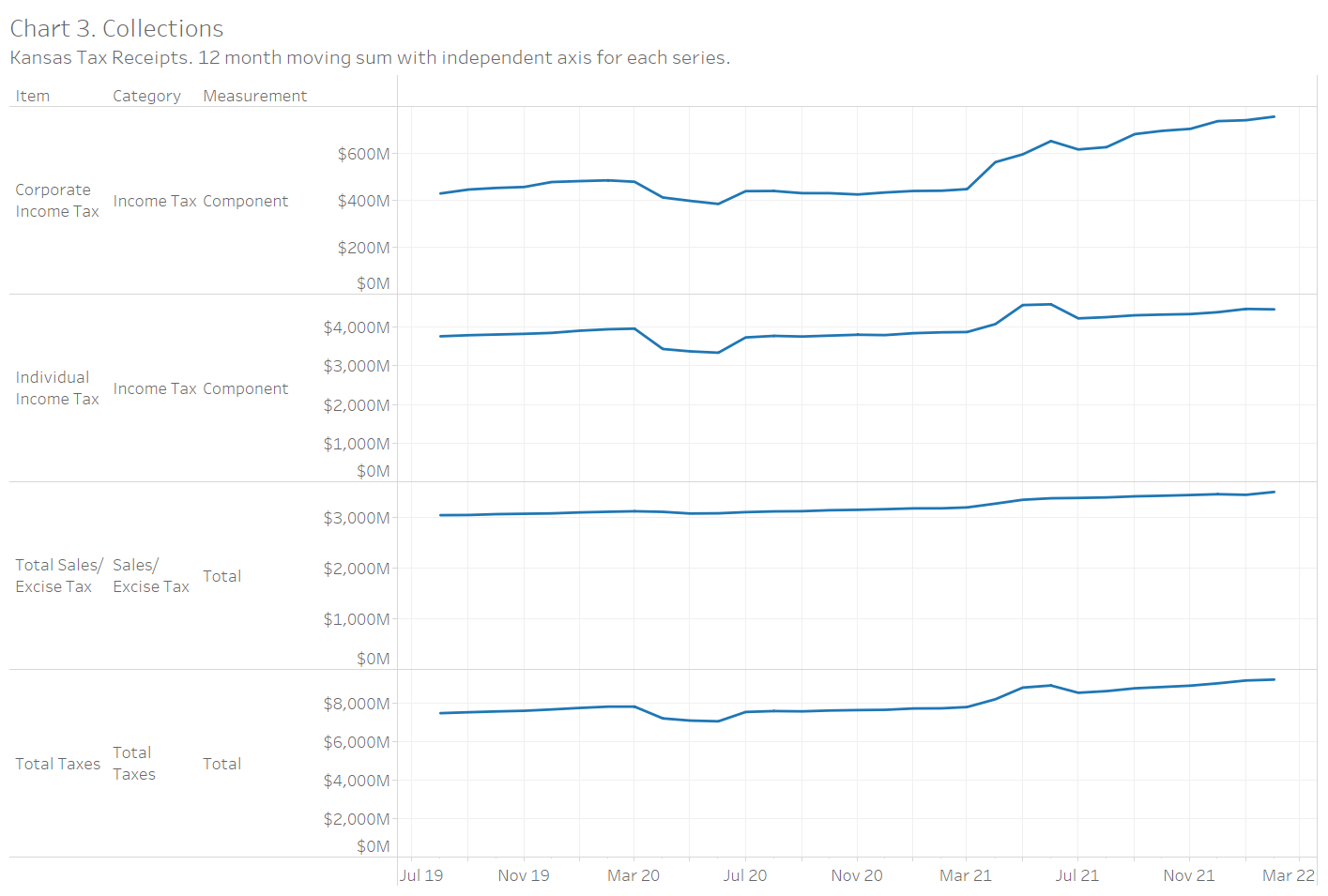

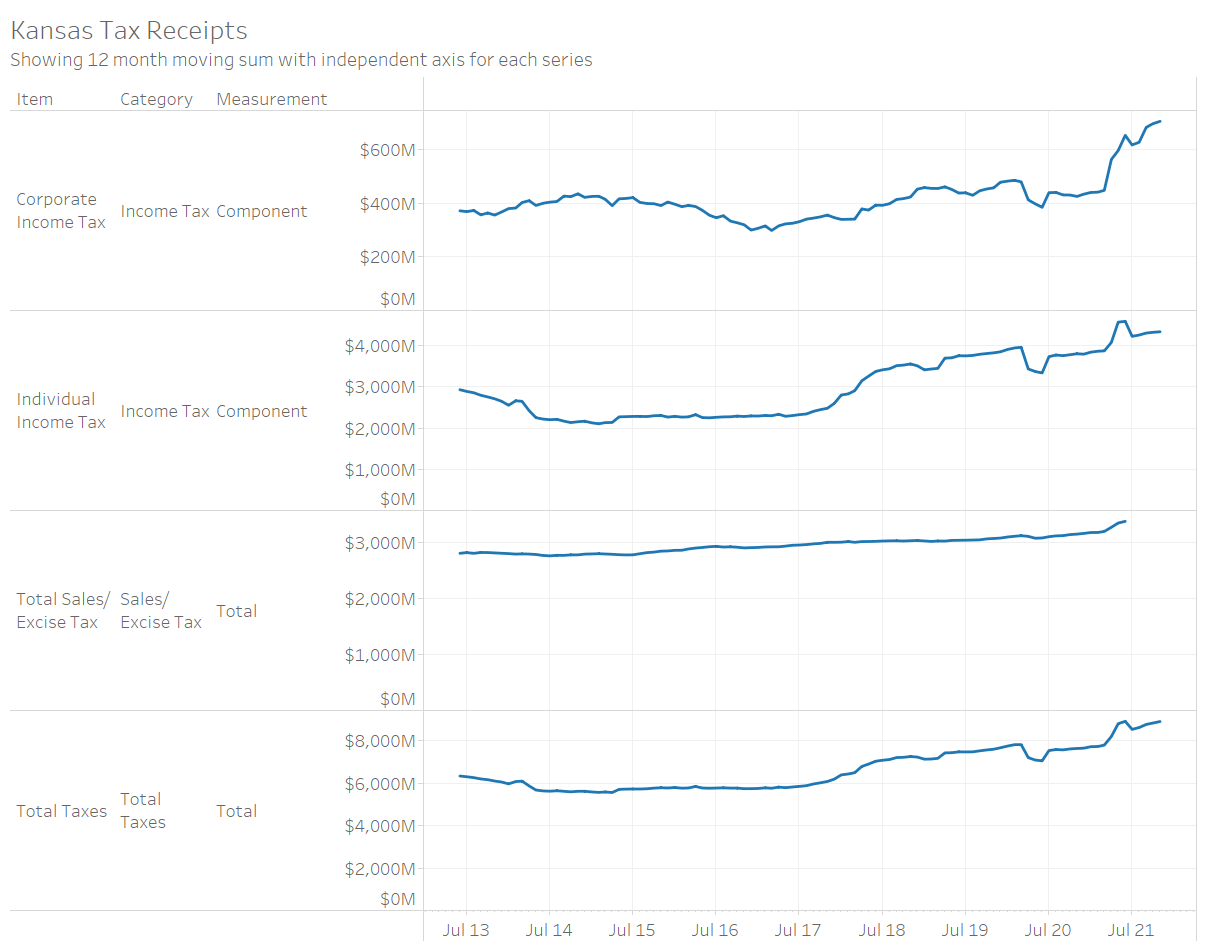

Kansas Tax Revenue, April 2022

For April 2022, Kansas tax revenue was 54.2 percent greater than April 2021, and collections through the first ten months of the fiscal year are 13.3 percent greater than the prior year.* Individual income tax was over twice the amount of last April.

-

Kansas Tax Revenue, March 2022

For March 2022, Kansas tax revenue was 15.2 percent greater than March 2021, and collections for the fiscal year are 6.6 percent greater than the prior year.

-

Kansas employment situation, January 2022

In Kansas for January 2022, the labor force grew slightly, the number of people working rose, and the unemployment rate fell, all compared to the previous month.

-

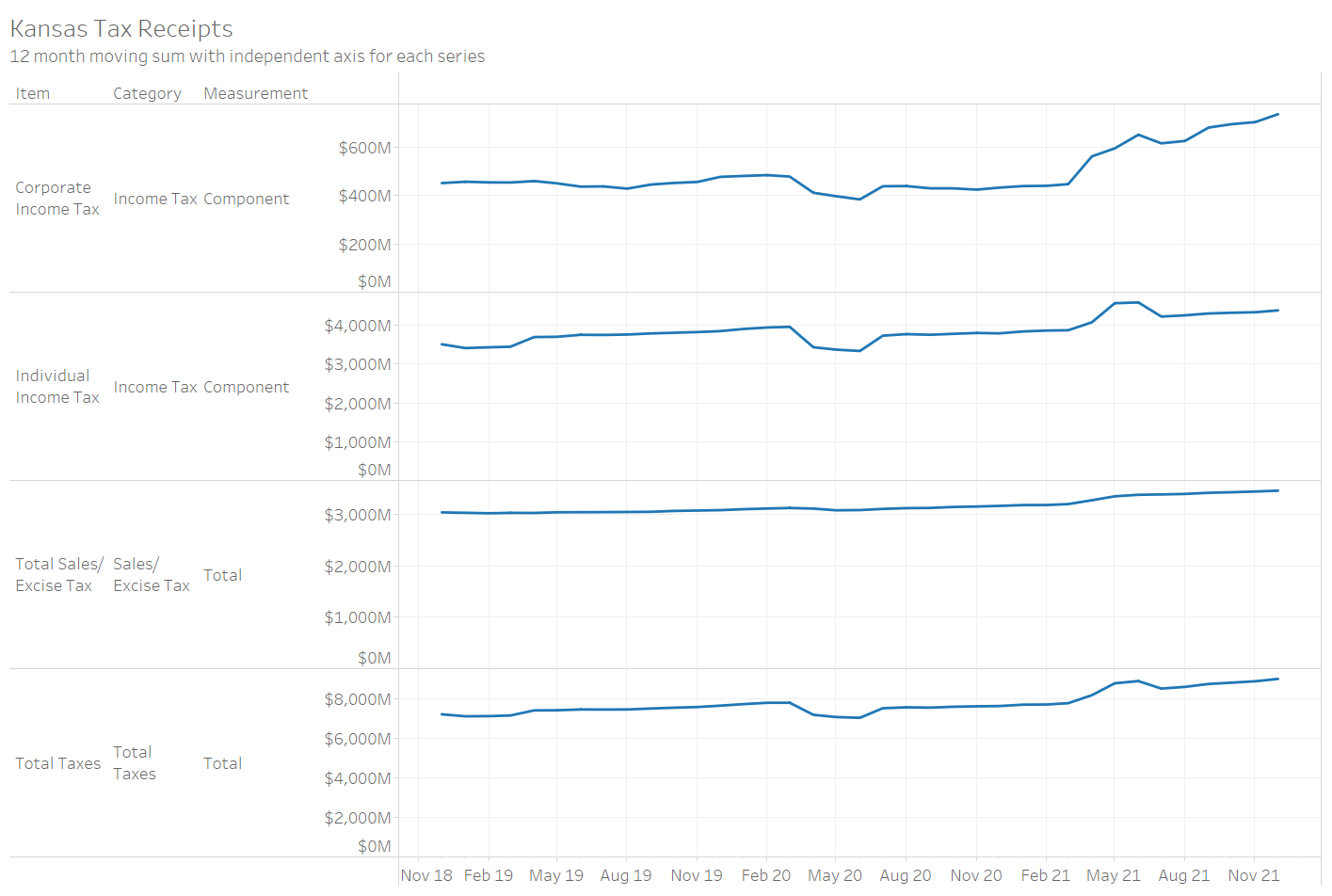

Kansas Tax Revenue, February 2022

For February 2022, Kansas tax revenue was 5.3 percent less than February 2021 and down 46.8 percent from January 2022.

-

Kansas Tax Revenue, January 2022

For January 2022, Kansas tax revenue was 18.7 percent greater than January 2021 and up 6.1 percent from December 2021.

-

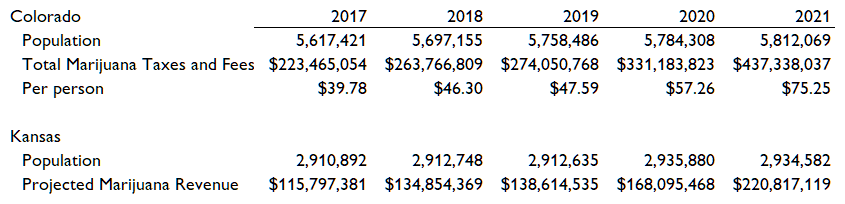

Marijuana Tax Revenue in Kansas

Tax revenue from the legalization of marijuana won’t make much difference, despite boosters’ claims.

-

State of the State in Kansas, 2022

This week saw competing assessments of Kansas and different visions for the future.

-

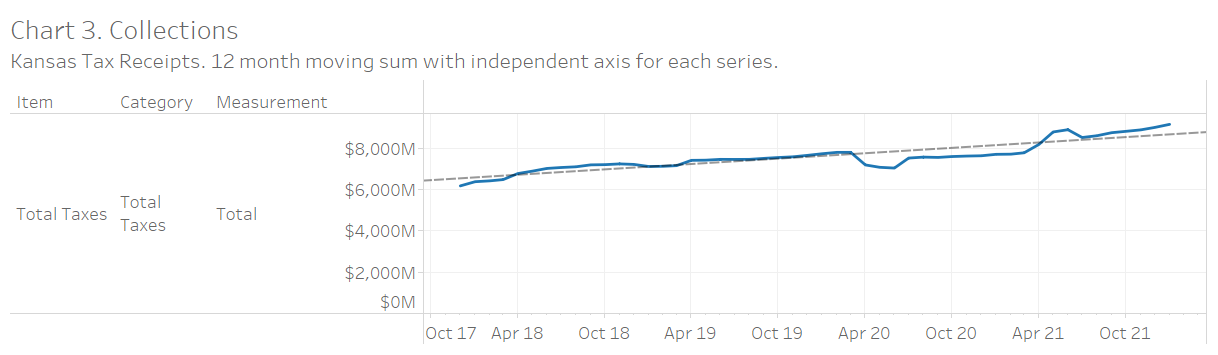

Kansas tax revenue, December 2021

For December 2021, Kansas tax revenue was 15.6 percent greater than December 2020, and 42.0 percent more than November.

-

Poverty and Income in Kansas Counties

Charts of household income and poverty rate for counties in Kansas.

-

Kansas tax revenue, November 2021

For November 2021, Kansas tax revenue was 12.6 percent greater than November 2020, and 5.4 percent less than October.