On the campaign trail, former president Donald J. Trump praises his import taxes on Chinese imports. But he is wrong on the data, and wrong on the economic effects.

This is Donald J. Trump speaking at a recent campaign event:

I took on Communist China like no administration in history, bringing in hundreds of billions of dollars pouring right into our Treasury when no other president had gotten even literally 10 cents out of China. Nobody even tried. We took in hundreds of billions of dollars. I gave 28 billion dollars directly to the farmers, and in your case, we gave it also to the New England lobstermen and fishermen.

(See Donald Trump Holds Final Rally Before N.H. Primary Transcript)

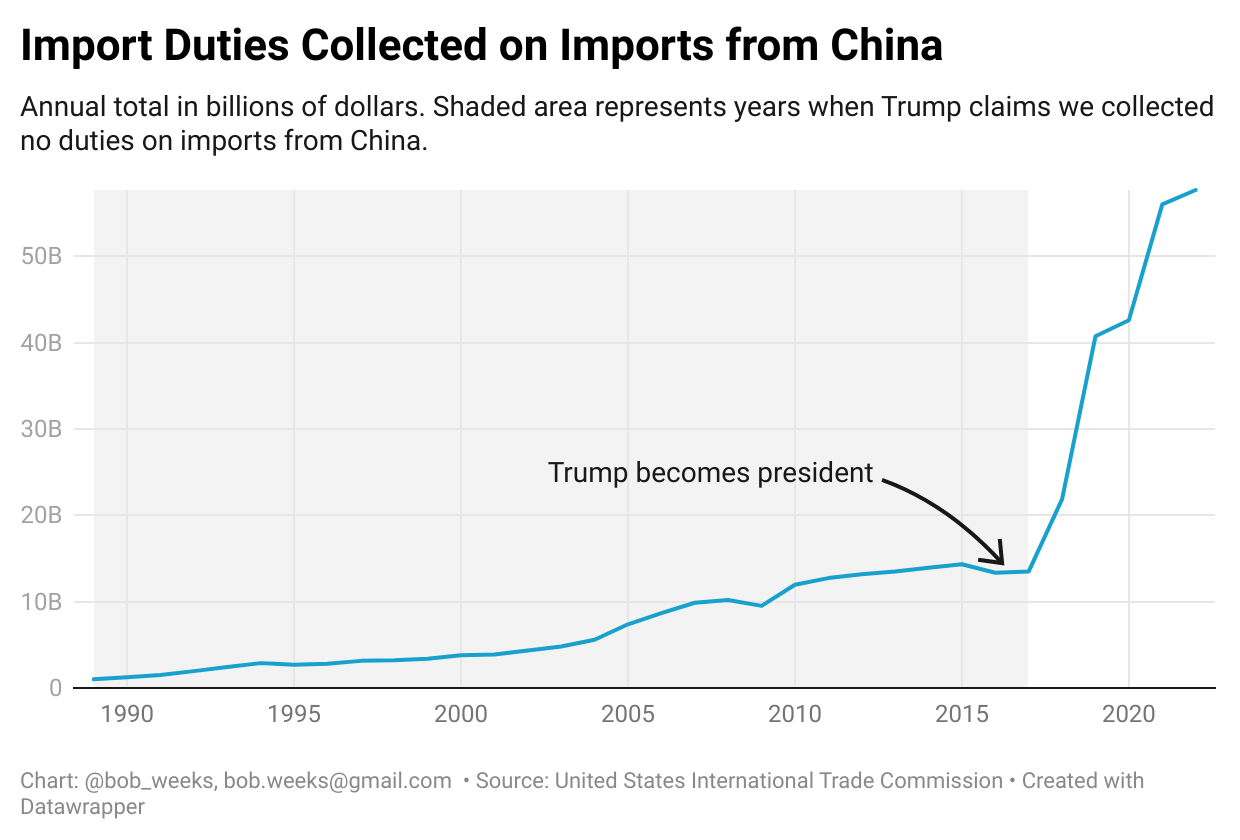

First, while Trump raised the tariff rate applied to imports from China, the United States had been collecting duties on Chinese imports. The nearby chart illustrates the steep rise after Trump took office, along with a shaded period when Trump claimed the U.S. collected nothing.

Second, we need to examine who pays these import duties. Trump says China pays. Nearly everyone else — from left to right, liberal to conservative — says that Americans pay and that the U.S. economy is harmed.

In an interview, Howard Gleckman of the left-leaning Tax Policy Center explained (emphasis added):

A tariff is a tax on imported goods. Despite what the President says, it is almost always paid directly by the importer (usually a domestic firm), and never by the exporting country. Thus, if the US imposes a tariff on Chinese televisions, the duty is paid to the US Customs and Border Protection Service at the border by a US broker representing a US importer, say, Costco.

Later, in the same interview:

Who really pays the tax on imported goods? The answer, I am sorry to say is, it depends.

A business will, if it can, pass its higher after-tax costs on to consumers. Thus, the price of Chinese TVs sold in the US may rise rapidly. But the firms selling those TVs eventually will face competition from companies that sell lower-cost TVs made in a third country that is not subject to the import tax. In that case, some of the tax may be paid by the firm’s shareholders in the form of lower profits or by its workers in the form of lower compensation. Or, the firm may switch to a non-Chinese supplier and, in effect, nobody will pay the tariff.

What is the effect?

In the short run, higher prices for imported goods will reduce consumption of those goods. But in the longer term, the decline in competition from foreign products makes domestic firms less efficient. And less competition will result in higher prices, not just for those goods subject to the tariff but for competing goods that are not—such as those made domestically. In the case of Trump’s tariffs on China, that means US consumers will pay somewhat higher prices.

(See: TaxVox: Business Taxes)

The Tax Foundation, which is not left-leaning, reports:

When the U.S. imposes tariffs on imports, U.S. businesses directly pay import taxes to the U.S. government on their purchases from abroad.

Noting that President Biden has continued the Trump tariffs:

Historically, economists have generally found that foreign firms have absorbed some of the burden of tariffs by lowering their prices, meaning domestic firms and consumers haven’t borne the entirety of higher tariffs in the past. In contrast to past studies, however, new studies have found the Trump-Biden tariffs have been passed almost entirely through to U.S. firms or final consumers.

This article reports several recent studies examining recent tariffs. One looked at tariffs on “washing machines, solar panels, aluminum, steel, and goods from the European Union and China imposed in 2018 and 2019,” finding:

They found that U.S. firms and final consumers bore the entire burden of tariffs and estimated a net loss to the U.S. economy of $16 billion annually, including more than $114 billion in losses to firms and consumers, offset by small gains to protected producers and revenue gains to the government.

(Who Really Pays the Tariffs? U.S. Firms and Consumers, Through Higher Prices)

In another article, Tax Foundation notes:

Historical evidence and recent studies show that tariffs raise prices and reduce available quantities of goods and services for U.S. businesses and consumers, which results in lower income, reduced employment, and lower economic output. For example, the effects of higher steel prices, largely a result of the 2002 Bush steel tariffs, led to a loss of nearly 200,000 jobs in the steel-consuming sector, a loss larger than the total employment in the steel-producing sector at the time.

(See Tariffs and Trade)

In testimony to Congress, Bryan Riley of the conservative National Taxpayers Union, wrote:

There is overwhelming evidence that U.S. trade barriers weaken our internal economy.

He referenced a 1983 investigation conducted in the midst of the Cold War:

Trade restrictions impose hidden costs on the economy. They are not included in the appropriations of elected officials, they show up on no agency’s budget, and they tend to be overlooked when assessing the impact of the broader policy of which they are a part. But hidden or not, these costs act as a drag on the rest of the economy, eroding the industrial base in other sectors, and undermining our ability to sustain a balanced defense effort in a national emergency.

He also mentioned a letter signed by more than 1,100 U.S. economists, including 15 Nobel laureates. They wrote:

We are convinced that increased protective duties would be a mistake. They would operate, in general, to increase the prices which domestic consumers would have to pay. A higher level of protection would raise the cost of living and injure the great majority of our citizens.

It also explains the two-way nature of trade between nations:

Our export trade, in general, would suffer. Countries cannot permanently buy from us unless they are permitted to sell to us, and the more we restrict the importation of goods from them by means of ever higher tariffs the more we reduce the possibility of our exporting to them. Such action would inevitably provoke other countries to pay us back in kind by levying retaliatory duties against our goods.

Further, Riley notes that trade is good for peace:

Many studies have been conducted on the relationship between trade and peace. One recent report concluded: “… trade alliances give other states more of an incentive to defend allies that come under attack. That line of thinking seems to play out in the data. As the models predict, countries are less likely to be at war with their trading partners, and countries with more trading partners are less likely to go to war in the first place.”

Leave a Reply