Tag: Corporate welfare

-

Wichita Chamber speaks on county spending and taxes

The Wichita Metro Chamber of Commerce urges spending over fiscally sound policies and tax restraint in Sedgwick County.

-

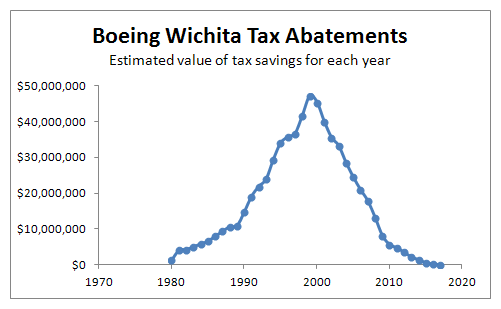

In Sedgwick County, expectation of government entitlements

In Sedgwick County, we see that once companies are accustomed to government entitlements, any reduction is met with resistance.

-

Government creates obstacles to progress

“Overcoming obstacles can be a difficult challenge even on a level playing field. We need to change the rigged system that favors the politically connected over the hardworking, honest citizen,” writes Charles Koch in a recent edition of Perspectives.

-

A Wichita Shocker, redux

Based on events in Wichita, the Wall Street Journal wrote “What Americans seem to want most from government these days is equal treatment. They increasingly realize that powerful government nearly always helps the powerful …” But Wichita’s elites don’t seem to understand this.

-

Community improvement districts in Kansas

In Kansas Community Improvement Districts, merchants charge additional sales tax for the benefit of the property owners, instead of the general public.

-

Year in Review: 2014

Here is a sampling of stories from Voice for Liberty in 2014.

-

Wichita Metro Chamber of Commerce: What is the attitude towards taxes?

Does the Wichita Metro Chamber of Commerce support free markets, capitalism, and economic freedom, or something else?

-

Wichita to consider tax exemptions

A Wichita company asks for property and sales tax exemptions on the same day Wichita voters decide whether to increase the sales tax, including the tax on groceries.

-

WichitaLiberty.TV: Author and philosopher Andrew Bernstein

Andrew Bernstein is a proponent of Ayn Rand’s Objectivism, an author, and a professor of philosophy. We talk about capitalism and other subjects.