When the Wichita city council delegates spending to outside agencies such as Visit Wichita, it should insist on the same transparency requirements the city itself faces.

The Kansas Open Records Act is designed to give citizens access to data concerning their government. In the words of the Kansas Attorney General, “An open and transparent government is essential to the democratic process.”

The preamble to the Kansas act states, “It is declared to be the public policy of the state that public records shall be open for inspection by any person unless otherwise provided by this act, and this act shall be liberally construed and applied to promote such policy.” (emphasis added)

That isn’t always the case in Wichita. Here, the city has formed several non-profit organizations that are funded in large part by tax revenue. But these organizations believe they are not covered by KORA, and so far the city agrees with that.

An example is Visit Wichita, the city’s convention and visitors bureau. This week the Wichita City Council will consider the scope of services and budget for the money the agency receives from Wichita’s Tourism Business Improvement District. This is a tax of 2.75 percent that is added to hotel bills in the city. From 2016 to 2018 this tax brought in an average of just over three million dollars per year.

If the city itself was spending these funds, there is no doubt that the spending records would be public. But Visit Wichita wants to spend this money in secret. It also wants to enter into contracts in secret.

In the Kansas law, here is the definition of a public agency: “‘Public agency’ means the state or any political or taxing subdivision of the state or any office, agency or instrumentality thereof, or any other entity receiving or expending and supported in whole or in part by the public funds appropriated by the state or by public funds of any political or taxing subdivision of the state.” There is an exception, which doesn’t apply here: “‘Public agency’ shall not include: … Any entity solely by reason of payment from public funds for property, goods or services of such entity.”

As can be seen in the nearby table, Visit Wichita gets around 93 percent of its funds from taxes. Surely this qualifies as “supported in whole or in part by the public funds.”

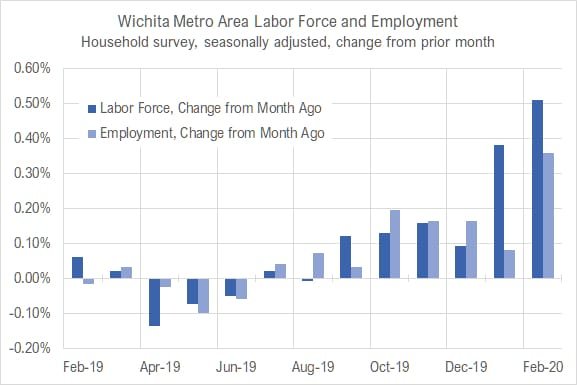

In the past, agencies have objected to the release of records on the basis that they would reveal information or strategies that would benefit Wichita’s competitors for jobs, conventions, and tourists. But the requests I have made (and which were rejected) asked for past data, not contemporaneous data. Further, if Wichita was successful in attracting jobs, conventions, and tourists, this might make some sense. But Wichita lags in these categories, which means that oversight is important. For example, among large hotel markets in Kansas, Wichita is near the bottom in growth.

The records that Visit Wichita needs to disclose are its spending records, which means the checks it has written and credit card charges made. It also needs to disclose its contracts. This is the law, and it is also good public policy.

When my records requests were rejected, I asked the Sedgwick County District Attorney to enforce the law. The DA sided with Visit Wichita (then known as Go Wichita) and the city’s other non-profit agencies, concluding that they were not “public agencies.”

That determination simply meant that Visit Wichita could not be forced to reveal records. But it does not prohibit the agency from supplying records — if it wanted.

This issue is important so that people can trust their government. But leadership in Wichita has not agreed. Now, as Wichita considers large public investments in facilities like a convention center — something desired by Visit Wichita — we need transparency, not secrecy.

Wichita Mayor Brandon Whipple campaigned on greater government transparency. An amendment to the city’s recommended action could require that Visit Wichita recognize itself for what it is — a public agency as defined in the Kansas Open Records Act. Proposing a motion to include this requirement would allow the mayor to fulfill a campaign promise, and it would let Wichitans know where council members stand on this issue.

For more information, see Open Records in Kansas.

Even over the ten-year life of the property tax abatement, the sales tax exemption is still 11.8 percent of the total tax forgiveness. That — the duration of the property tax abatement — is another opportunity to increase transparency. The CEDBR analysis gives the total cost of the incentives for ten years. (A nearby table summarizes.) These totals are speculative, as the city council must revisit the matter in five years to determine whether the company deserves the property tax abatement for an additional five years. (This is known as a “five-plus-five year tax exemption.”)

Even over the ten-year life of the property tax abatement, the sales tax exemption is still 11.8 percent of the total tax forgiveness. That — the duration of the property tax abatement — is another opportunity to increase transparency. The CEDBR analysis gives the total cost of the incentives for ten years. (A nearby table summarizes.) These totals are speculative, as the city council must revisit the matter in five years to determine whether the company deserves the property tax abatement for an additional five years. (This is known as a “five-plus-five year tax exemption.”)