Tag: Featured

-

Kansas efficiency study released

An interim version of a report presents possibilities of saving the state $2 billion over five years.

-

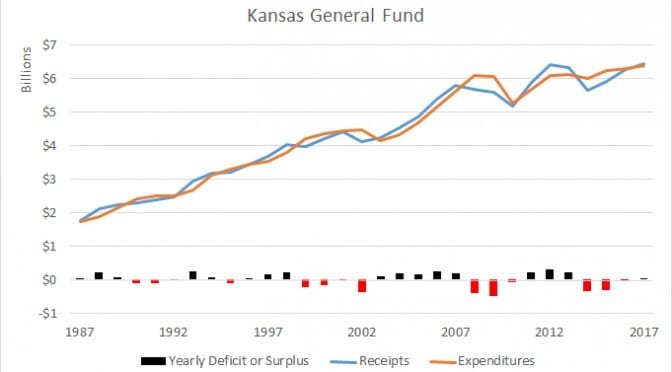

Kansas General Fund

Nominal dollar values. Click charts for larger versions.

-

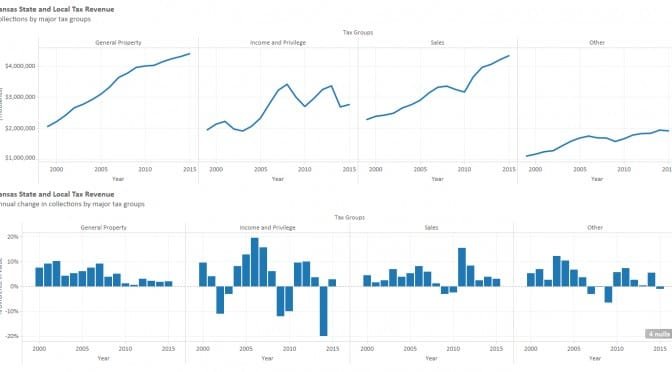

Kansas state and local tax revenue

Kansas state and local tax revenue

-

Kansas school employment

Kansas school employment declined for the current school year, and ratios of employees to pupils rose.

-

School choice in Kansas: The haves and have-nots

Kansas non-profit executives work to deny low-income families the school choice opportunities that executive salaries can afford.

-

Kansas legislative resources

Citizens who want to be informed of the happenings of the Kansas Legislature have these resources available.

-

Year in review: 2015

Here are highlights from the Voice for Liberty for 2015.

-

WichitaLiberty.TV: What the Kansas Legislature should do, and eminent domain

There are things simple and noncontroversial that the Kansas Legislasture should do in its upcoming session, and some things that won’t be easy but are important. Also, a look at eminent domain.

-

Availability of testimony in the Kansas Legislature

Despite having a website with the capability, only about one-third of standing committees in the Kansas Legislature are providing written testimony online.

-

A simple step for transparency in Kansas government

There exists a simple and inexpensive way for the Kansas Legislature to make its proceedings more readily available.

-

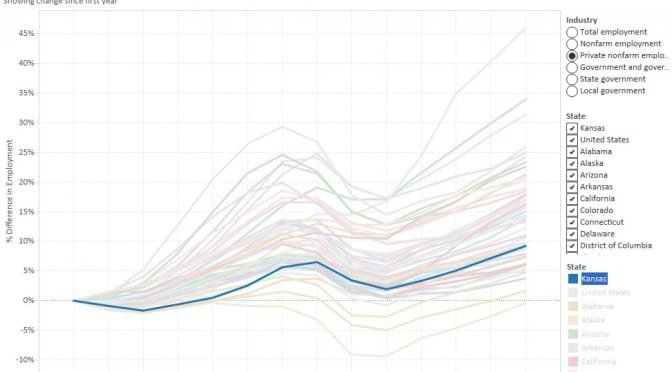

Employment by state and industry

An interactive visualization of employment in the states.

-

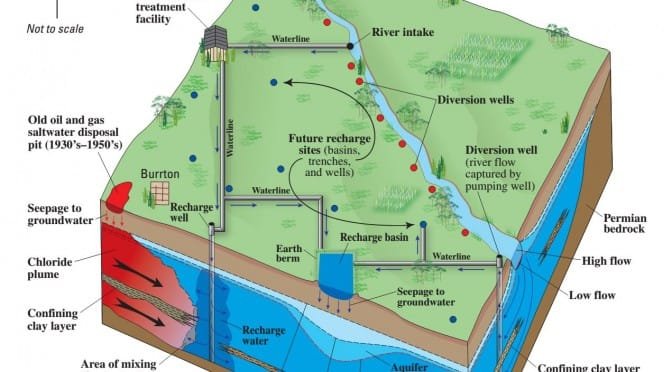

Wichita water statistics update

The Wichita ASR water project produced little water in November. There were 30 days when river flow was adequate.