Tag: Kansas news media

-

WichitaLiberty.TV: The Wichita Eagle fails the city and its readers

In this excerpt from WichitaLiberty.TV: In its coverage of the recent election, the Wichita Eagle has failed to inform its readers of city and state issues.

-

Newspaper editorialists with an ideology? Not in Kansas, surely.

Caution, Kansas newspaper editorialists. Your ideology is showing.

-

Recommended: Kansas Meadowlark

Kansas Meadowlark is the best site for aggregation of Kansas-centric news and opinion.

-

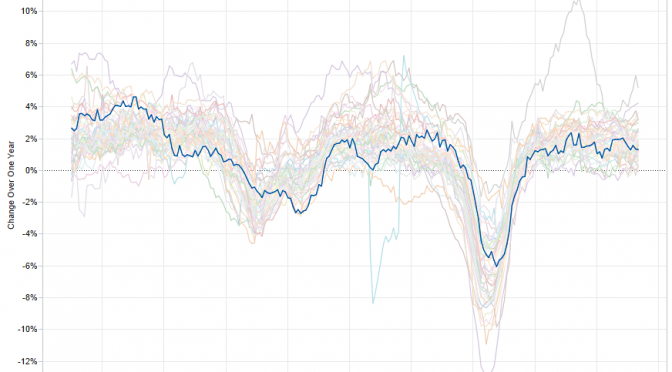

Job growth in the states and Kansas

Let’s ask critics of current Kansas economic policy if they’re satisfied with the Kansas of recent decades.

-

WichitaLiberty.TV: Newspaper editorial writers on how democracy works, Kansas school test scores.

An editorial in a Kansas newspaper exposes a dangerously uninformed and simplistic view of politics and democracy. Then, will Kansas school leaders and newspapers tell us the hidden truths about Kansas school test scores?

-

Kansas news media should report, not spin

Dave Trabert of Kansas Policy Institute explains that influence may be shifting from media, unions, the education establishment, cities, counties, and school boards to those with different views — those of limited government and economic freedom that empower citizens, not an expansive government and its beneficiaries.

-

WichitaLiberty.TV: Schools and the nature of competition and cooperation, Wind power and taxes

A Kansas newspaper editorial is terribly confused about schools and the nature of competition in markets. Then, we already knew that the wind power industry in Kansas enjoys tax credits and mandates. Now we learn that the industry largely escapes paying property taxes.

-

Shame, says Wichita Eagle editorial board

The Wichita Eagle editorial board rebukes the Kansas Legislature.

-

In Kansas, education is all about money and politics for UMEEA

Media reaction to the school finance legislation has been pretty predictable, focusing almost exclusively on institutions and ignoring the impact on students, writes Dave Trabert of Kansas Policy Institute.

-

Kansas newspapers against the children

A Kansas newspaper editorial illustrates that for the establishment, schools — the institution of public schools, that is — are more important than students.

-

Kansas school employment: Mainstream media notices

When two liberal newspapers in Kansas notice and report the lies told by a Democratic candidate for governor, we know there’s a problem.

-

What is the import of the farm bill to Kansas?

Correcting the Wichita Eagle’s facts will place the importance of the farm bill to Kansas in proper perspective.