Tag: Taxation

-

Wichita property tax rate, the history

The City of Wichita is fond of saying that it hasn’t raised its mill levy in many years. But the mill levy has increased in recent years, and the use of the tax revenue has shifted.

-

Few Wichitans support taxation for economic development subsidies

In Wichita, about one-third of voters polled support local governments using taxpayer money to provide subsidies to certain businesses for economic development.

-

Wichita’s benchmark not applicable to overlapping jurisdictions, it seems

The City of Wichita insists on a certain level of return on investment for its economic development incentives, but doesn’t apply that criteria to overlapping jurisdictions.

-

Poll: Wichitans don’t want sales tax increase

A scientific poll commissioned by Kansas Policy Institute finds that Wichitans are opposed to business incentives, want to pursue privatization over tax increases, and have concerns about how city hall has recently spent money.

-

End the wind production tax credit

If wind power cannot compete on its own after 20 years without costly special privileges, it never will, writes Lamar Alexander And Mike Pompeo.

-

CBPP misleading Kansans on revenue

Center on Budget and Policy Priorities is spreading false information about State of Kansas revenues.

-

In Kansas, tax giveaways for job creation found ineffective

Kansas has forked over millions in tax breaks since 2009, but new research says it has been ineffective at accomplishing its main goal: Creating new jobs.

-

Wichita economic development incentives: Do they help?

The Wichita City Council regularly awards economic development incentives. Are these incentives helpful, or not?

-

Two versions of the Kansas income tax cuts

There are two versions of the Kansas income tax cuts: The Media version and the reality, writes Steve Anderson of Kansas Policy Institute.

-

Kauffman paper on local business incentive programs

The paper “Evaluating Firm-Specific Location Incentives: An Application to the Kansas PEAK Program,” from the Ewing Marion Kauffman Foundation introduces a proposed evaluation method and applies it to Promoting Employment Across Kansas (PEAK), one of that state’s primary incentive programs.

-

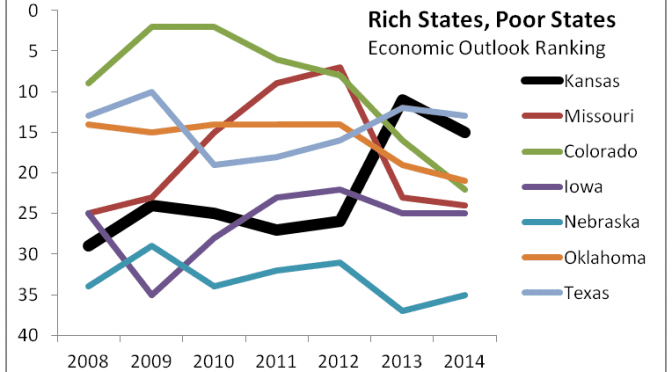

Rich States, Poor States for 2014 released

In the 2014 edition of Rich States, Poor States, Kansas continues with middle-of-the-pack performance rankings, and fell in the forward-looking forecast.

-

WichitaLiberty.TV: Schools and the nature of competition and cooperation, Wind power and taxes

A Kansas newspaper editorial is terribly confused about schools and the nature of competition in markets. Then, we already knew that the wind power industry in Kansas enjoys tax credits and mandates. Now we learn that the industry largely escapes paying property taxes.