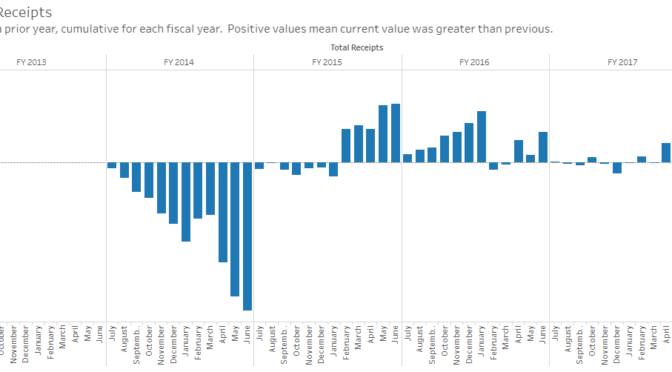

News about Kansas tax receipts for November 2017, along with an interactive visualization.

Following is a press release from the Kansas Department of Revenue regarding November 2017 tax receipts. For an interactive visualization of this data, see Visualization: Kansas tax receipts.

—

December 1, 2017

Tax receipts show promise of improved economy

TOPEKA–The state has collected $258.75 million over last fiscal year at this time, totaling over 11 percent growth in collections according to data from the latest revenue report released Friday.

So far this fiscal year that started in July, the state has collected $1.09 billion in total individual income tax, which amounts to $176.74 million over last year. In the same time, sales tax collections total $985.71 million, putting it $41.64 million over last year or over 4 percent growth. Corporate income tax continues the multi month trend of outperforming the previous year, hitting a value of $30.51 million over last year’s cumulative collections.

“Sales tax receipts have reached what appears to be stable growth above last year’s collections,” Revenue Secretary Sam Williams said. “Individual income tax collections are also above last year by a wide margin, but it’s difficult to distinguish the impact of the recent tax increase versus economic growth, and we won’t be able to discern that until April.

November tax receipts totaled $463.50 million, which is $62.23 million over November last year. Individual income tax collections totaled $207.62 million for the month, while sales tax revenue came in at $192.63 million. Corporate income tax totaled $379,518.