Tag: Kansas state government

-

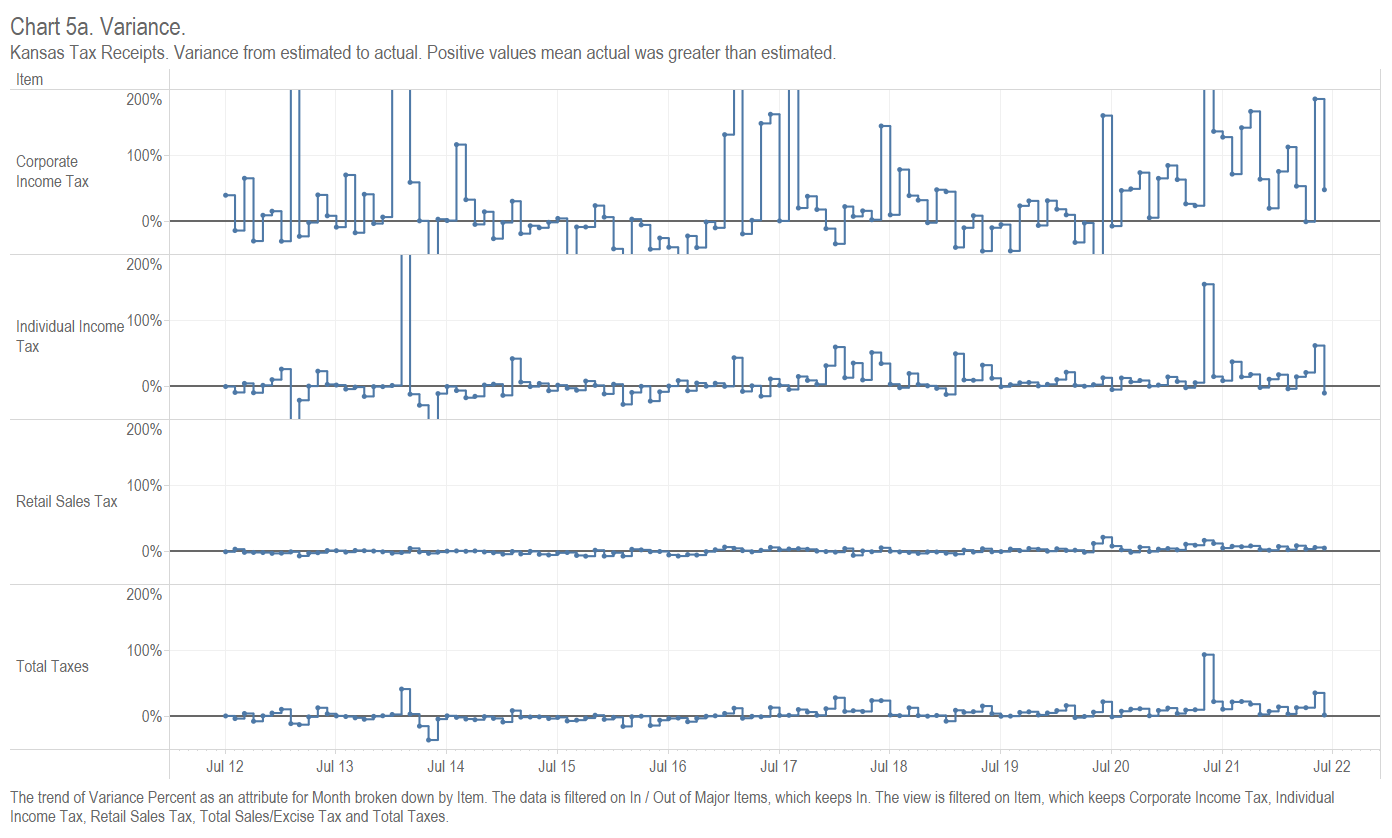

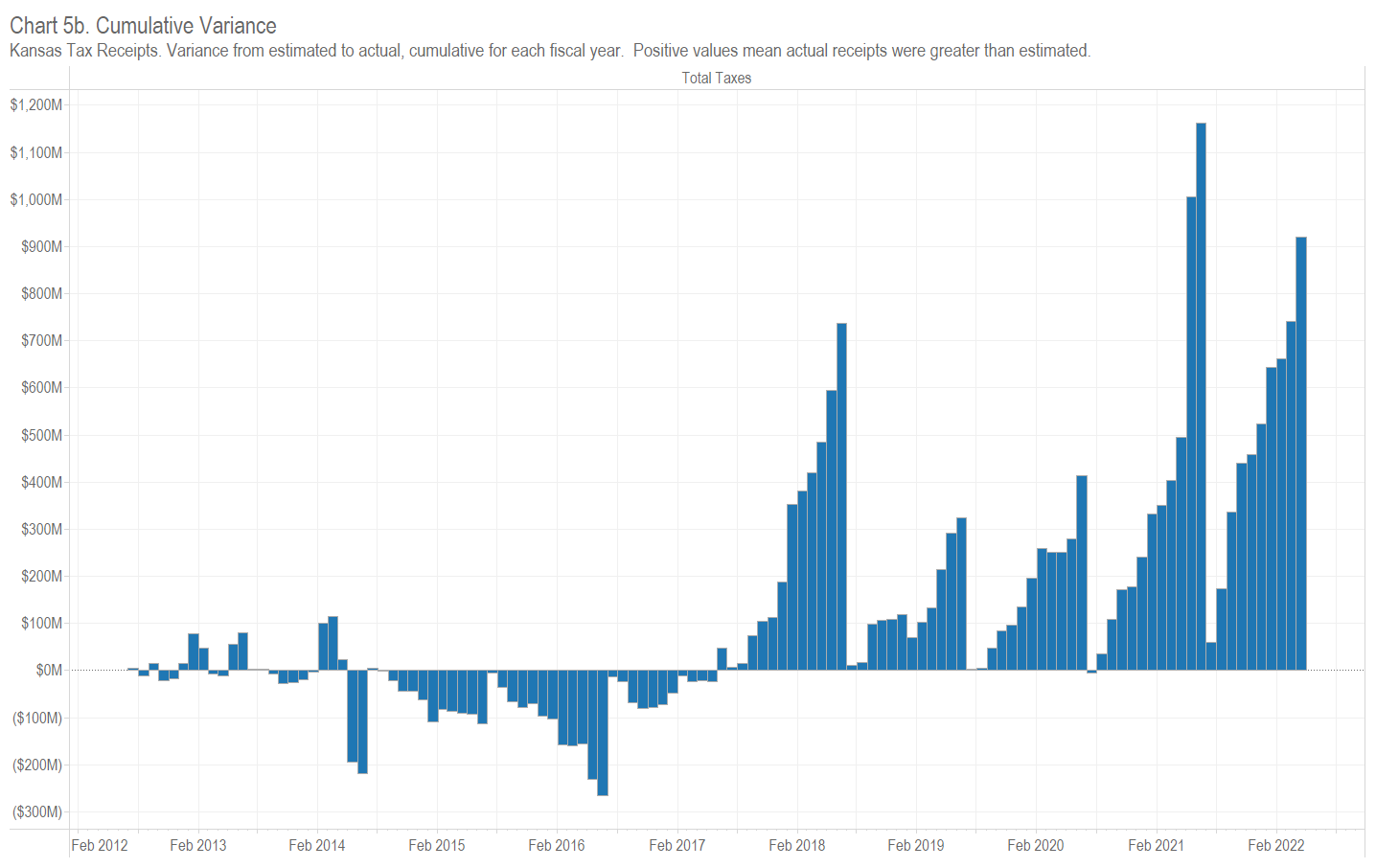

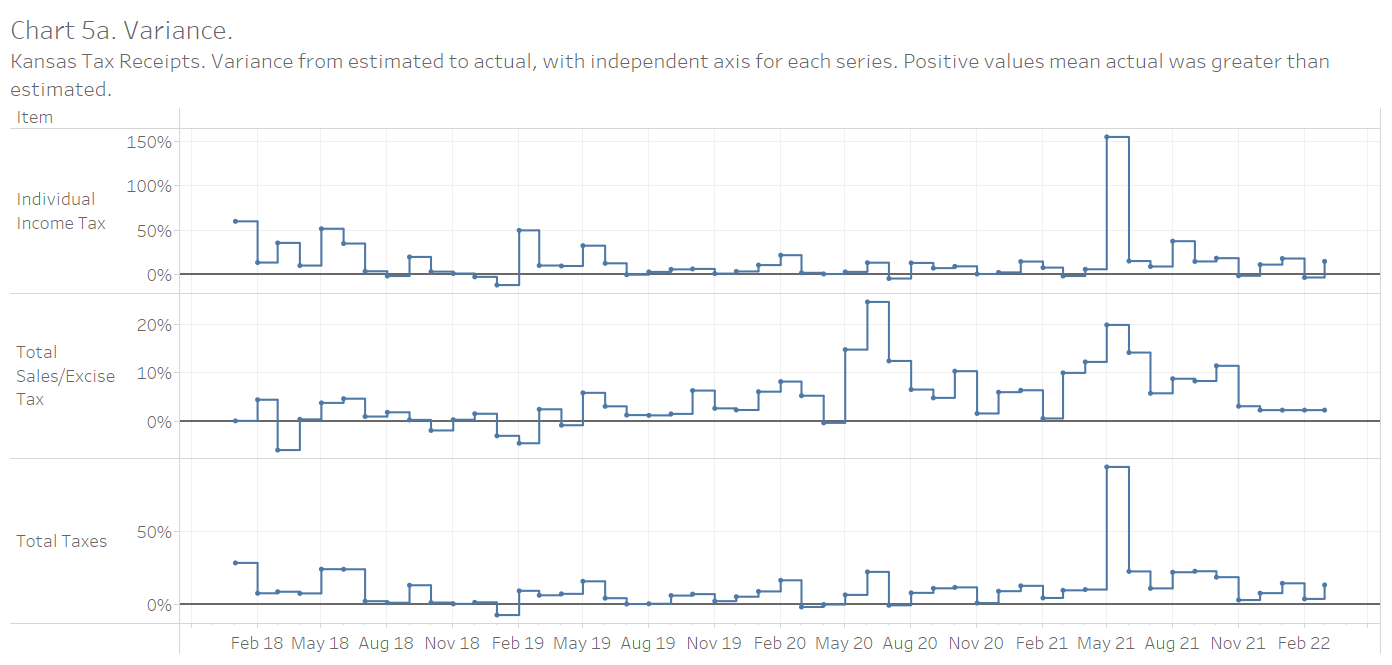

Kansas Tax Revenue, June 2022

For June 2022, Kansas tax revenue was 7.5 percent greater than June 2021. Collections for the entire 2022 fiscal year are 9.5 percent greater than the prior year.

-

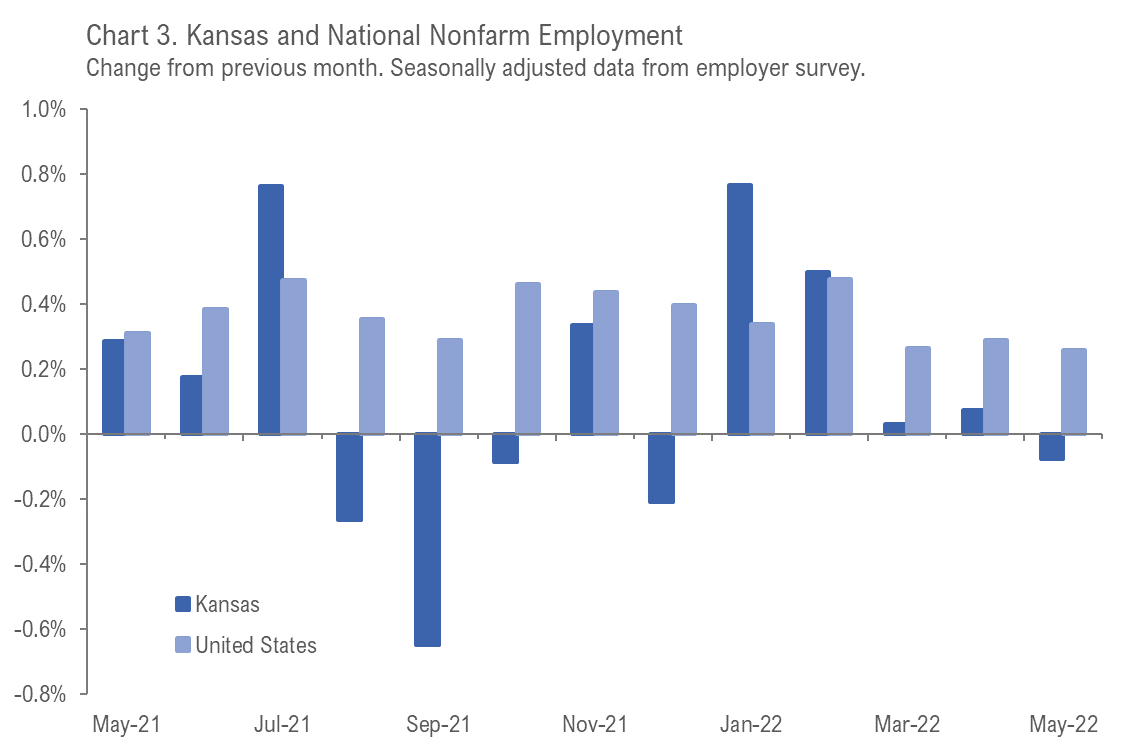

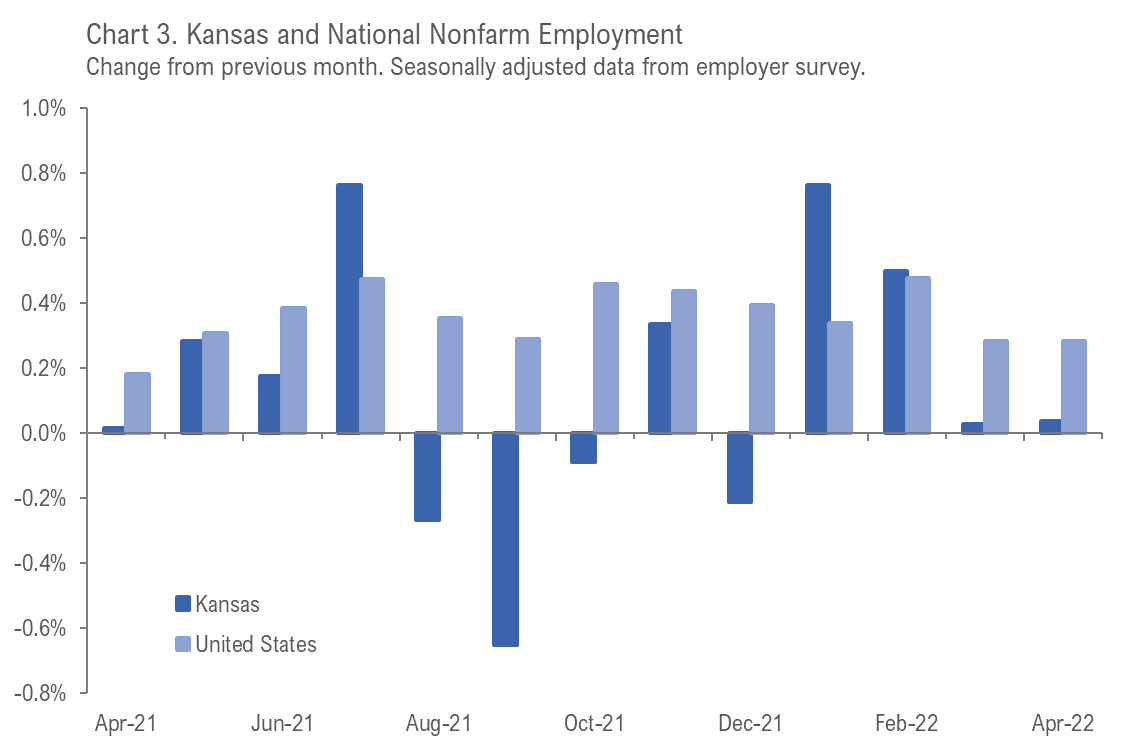

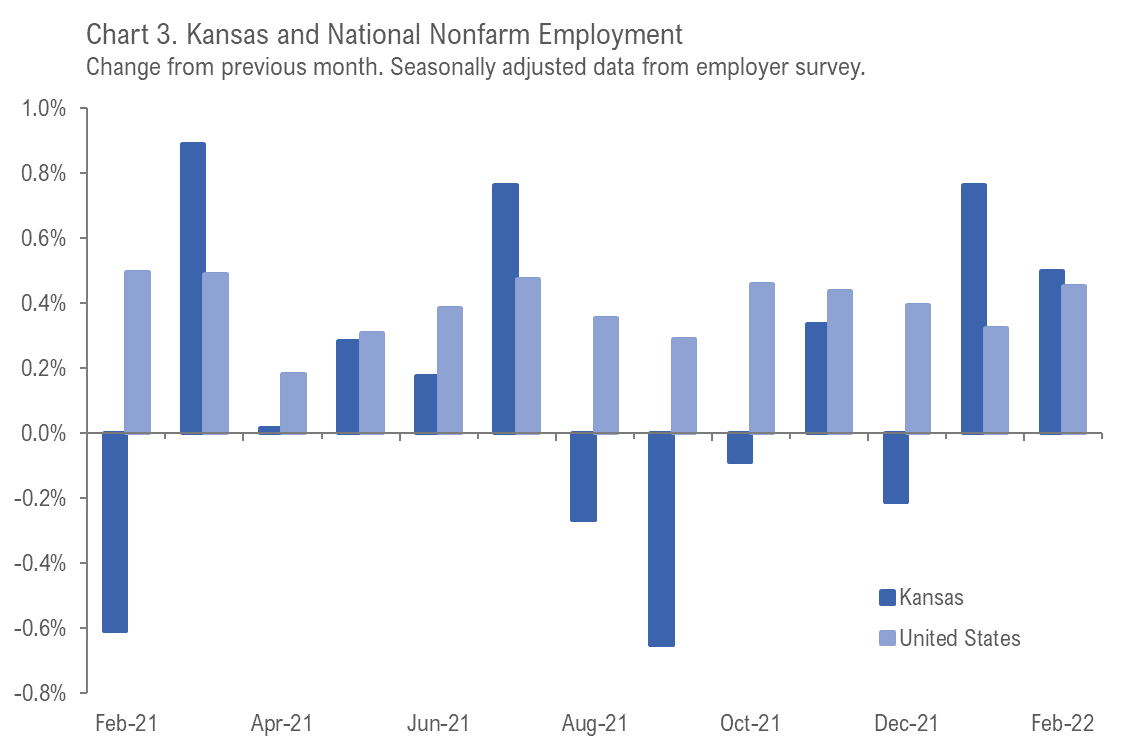

Kansas employment situation, May 2022

In Kansas for May 2022, the labor force grew, the number of people working fell slightly, and the unemployment rate fell, all compared to the previous month. Over the year, Kansas job growth was worst among the states.

-

Kansas Tax Revenue, May 2022

For May 2022, Kansas tax revenue was 13.6 percent less than May 2021. Collections through the first eleven months of the fiscal year are 9.7 percent greater than the prior year.

-

Kansas employment situation, April 2022

In Kansas for April 2022, the labor force grew slightly, the number of people working was nearly unchanged, and the unemployment rate was unchanged, all compared to the previous month.

-

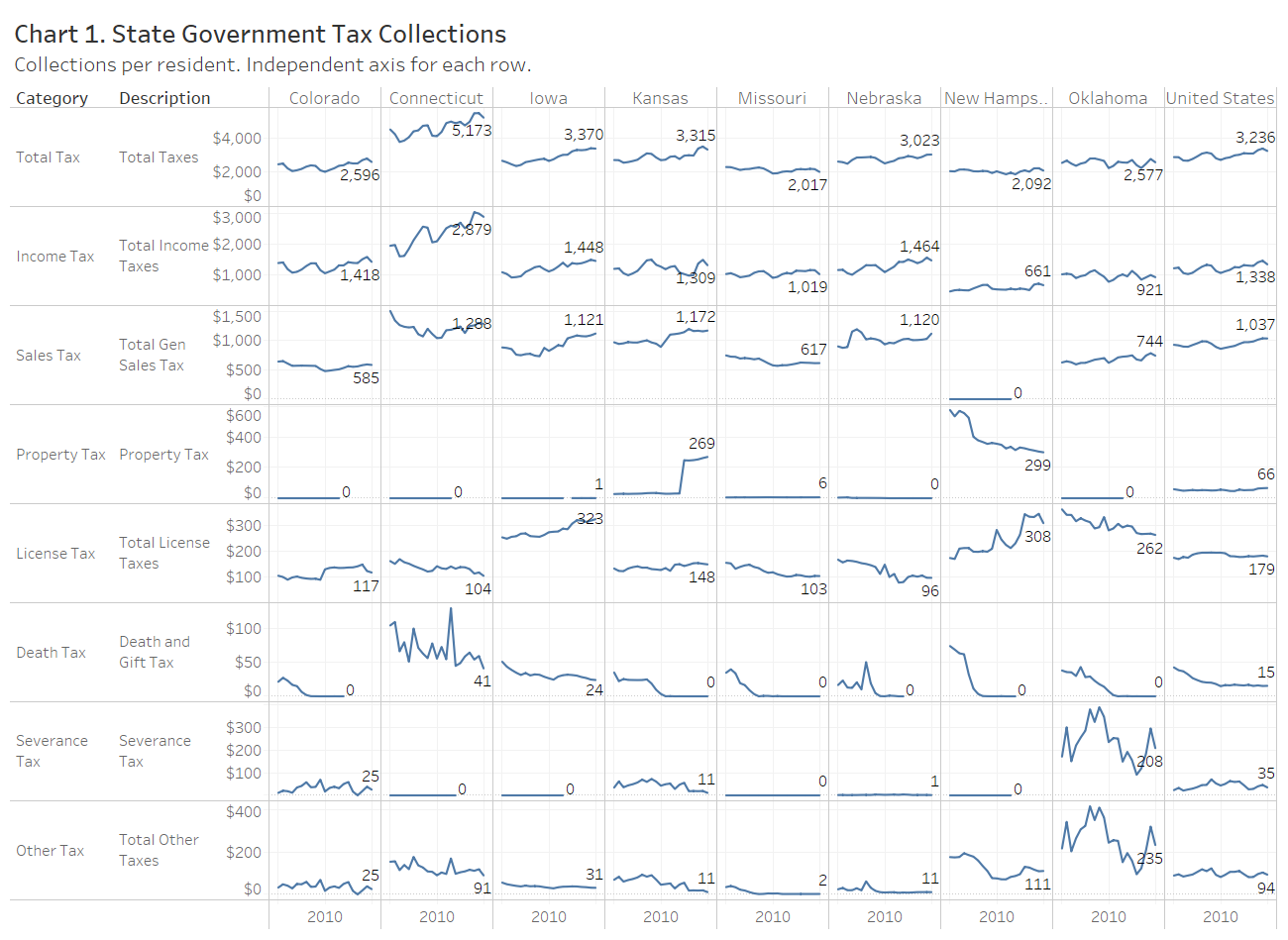

Kansas State Government Tax Collections for 2021

Kansas state government tax collections rose to $3,958 per person in 2021, an increase of 14.9 percent from 2020, and of 9.2 percent from 2019.

-

Kansas Tax Revenue, April 2022

For April 2022, Kansas tax revenue was 54.2 percent greater than April 2021, and collections through the first ten months of the fiscal year are 13.3 percent greater than the prior year.* Individual income tax was over twice the amount of last April.

-

Kansas Tax Revenue, March 2022

For March 2022, Kansas tax revenue was 15.2 percent greater than March 2021, and collections for the fiscal year are 6.6 percent greater than the prior year.

-

Kansas employment situation, March 2022

In Kansas for March 2022, the labor force grew slightly, the number of people working fell, and the unemployment rate was unchanged, all compared to the previous month.

-

Kansas GDP, fourth quarter of 2021

In the fourth quarter of 2021, the Kansas economy expanded at the annual rate of 1.5 percent. Gross Domestic Product grew in 47 states, with Kansas ranking forty-sixth.

-

Kansas employment situation, February 2022

In Kansas for February 2022, the labor force grew slightly, the number of people working rose, and the unemployment rate fell, all compared to the previous month.

-

Kansas Personal Income

For the fourth quarter of 2021, the rate of personal income growth in Kansas was near the bottom of the states, although Kansas fared better for the entire year.

-

Kansas State Government Tax Collections for 2020

Kansas state government tax collections fell to $3,315 per person in 2020, a decrease of 4.9 percent from 2019.